¶ Sales Tax & Charges Template

Sales tax template is used for the internal records of the company, whether a sales order or a sales Invoice can be generated seamlessly by using these templates. It is very similar to the Sales Tax and Charges Templates.

Prerequisites

¶ Comprehensive Guide to Create salesTax Template

-

¶ Step I - Check the Pre - Define Ledgers

In Accu360 ERP the Ledger for Output Tax are pre- defined under Duties & Taxes whose Names are IGST, CGST, SGST

- Name them Accordingly as per the Requirements of the Company or leave them as it is.

Open Chart of Accounts < Click Expand all < Under Duties & Taxes you may find 3 Ledgers Namely : IGST , CGST , SGST

-

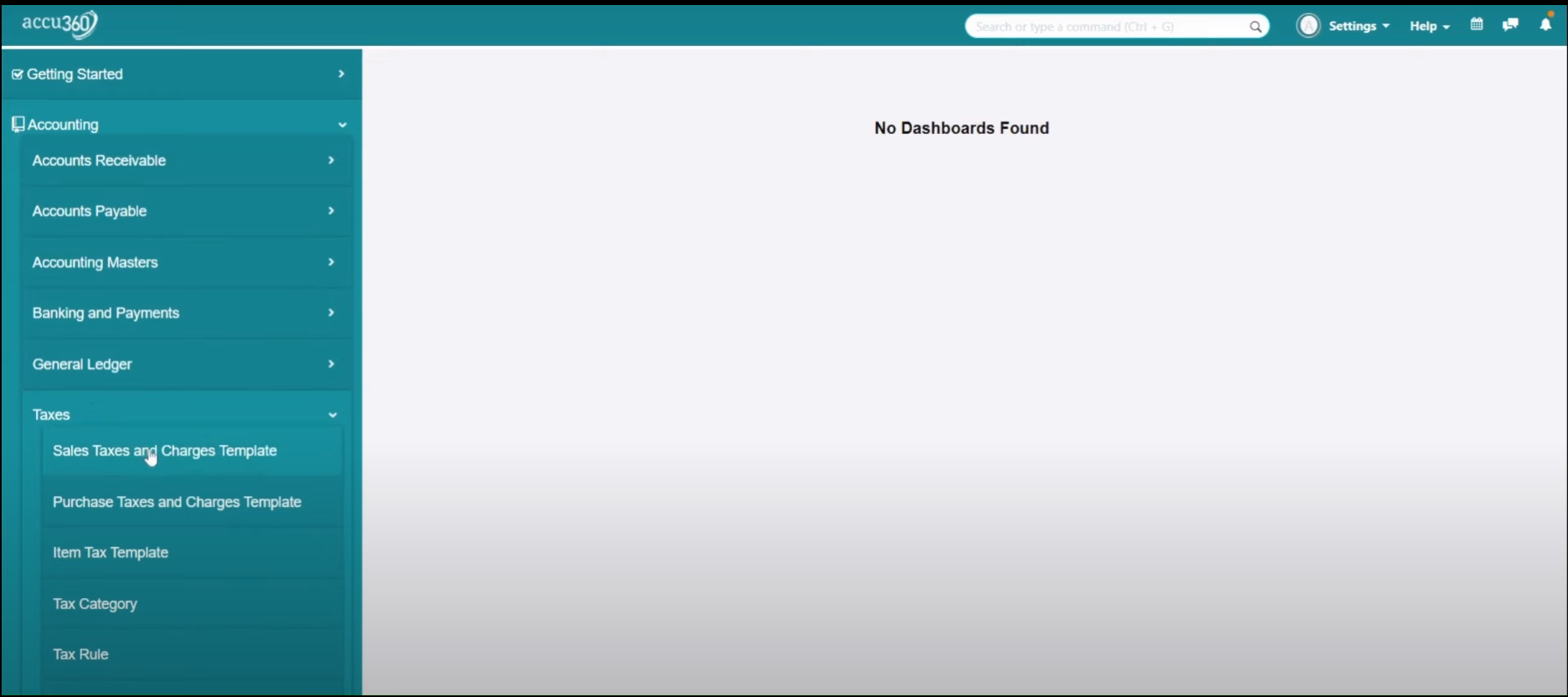

¶ Step II - Access Sales Tax & Charges Template

Go to Accounting Module < Click Taxes < Select SalesTax & Charges Template

-

¶ Step III - Add New SalesTax Template

Click on the “+” Icon in the Right Corner to add new Sales Tax Template

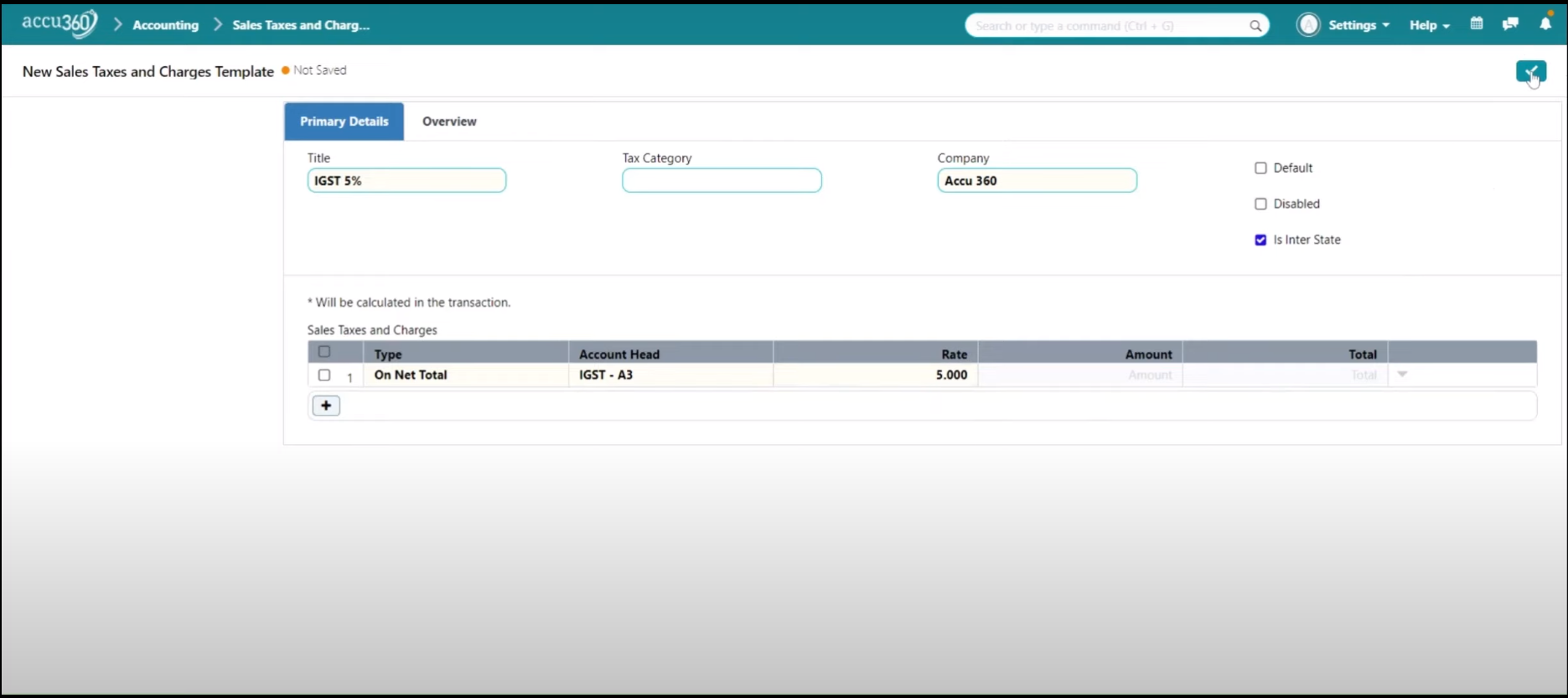

Example I - IGST 5%

Click the Option IS INTER STATE as IGST is Applicable to Inter State Transactions Only

Define On Net Total in “Type”

Mention the Rate of tax in “RATE” in this case 5%

In the Account Head Select the Respective Ledgers which was created in Step I

here in this Example IGST for IGST - 5% same goes for IGST - 12%, 18%, 28%

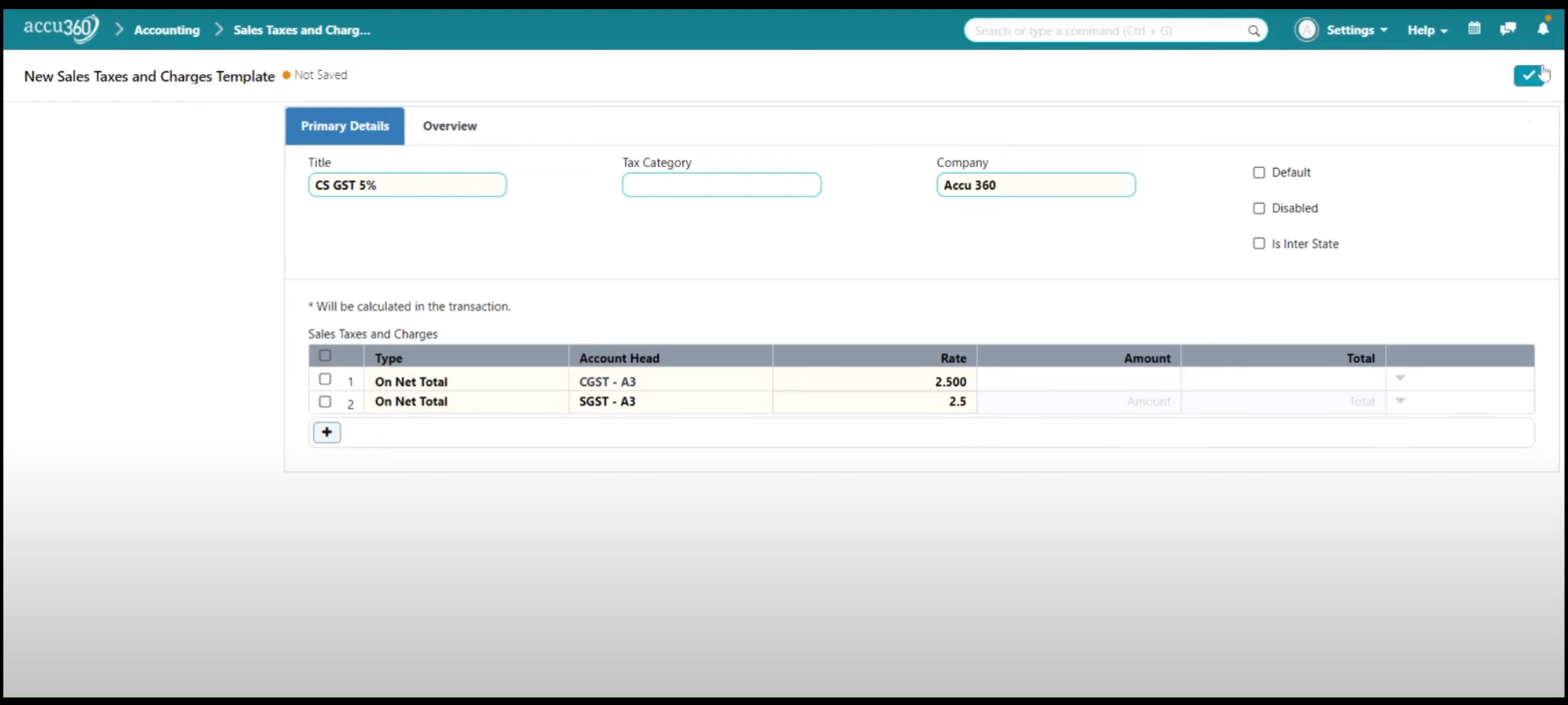

Example II - CS GST 5%

Do not Click the Option IS INTER STATE as C&S GST is Applicable to Intra State Transactions only.

Define On Net Total in “Type”

Mention the Rate of tax in “RATE” in this case 2.5% for CGST & 2.5% for SGST

In the Account Head Select the Respective Ledgers which was created in Step I

here in this Example CGST for CGST - 2.5% same goes for CGST - 6%, 9%, 14% & SGST for SGST - 2.5% same goes for SGST - 6%, 9%, 14%

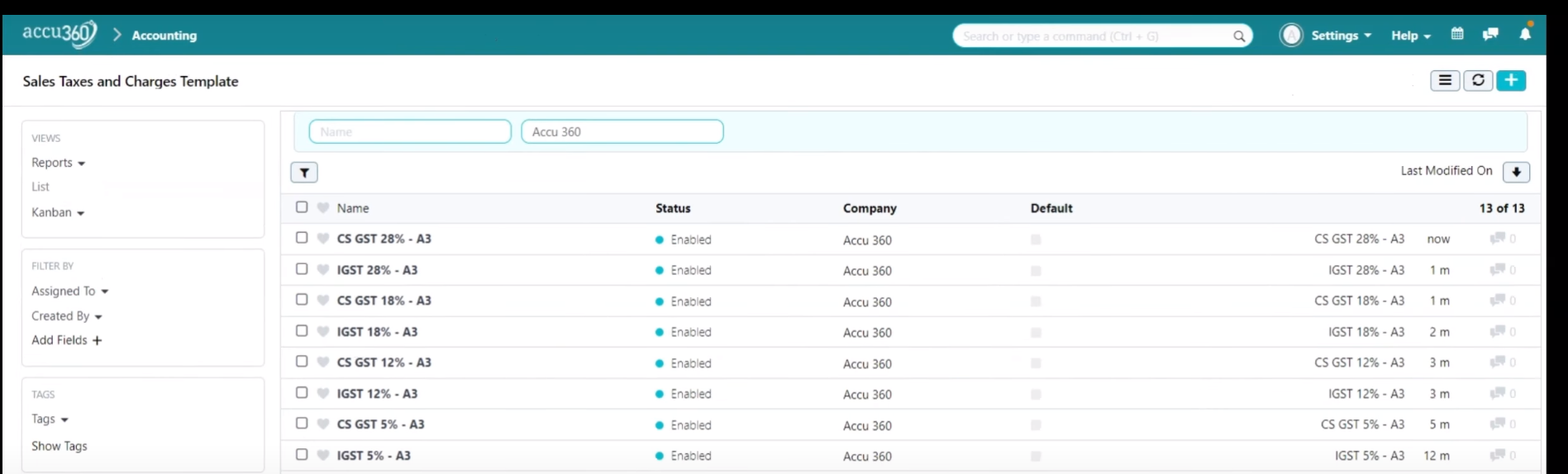

ALL Sales Taxes

After defining all the salesTaxes the list view will appear like this