¶ Item creation

Item creation in Accu360 ERP is a fundamental process that involves setting up and defining various aspects of products or items that a company deals with. It includes goods and services both.

Prerequisites

¶ Comprehensive Guide to Create Item Master

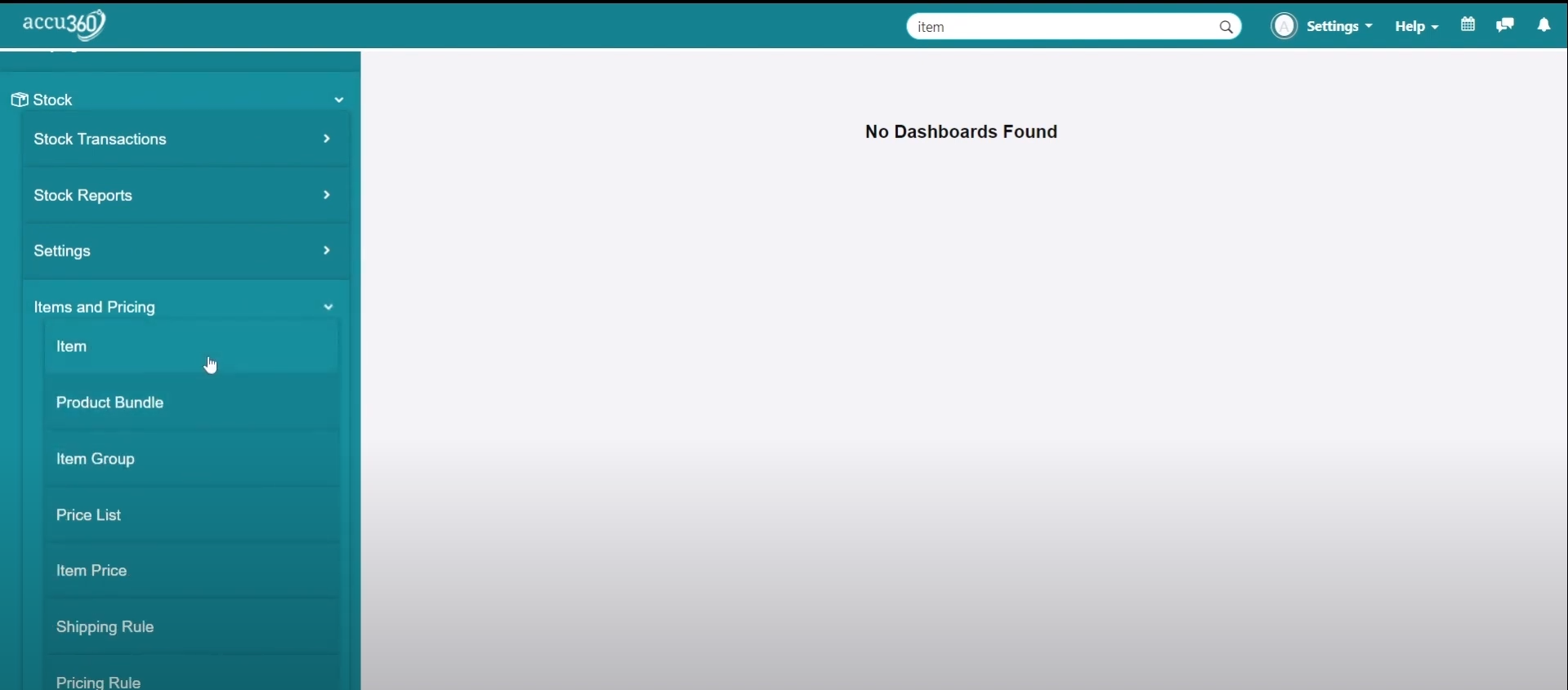

¶ Step 1 - Navigate to the Item List:

Home > Stock Module > Items and Pricing > Item

- Click on the “Stock” module.

- Access Items and Pricing within the Stock module.

- Select “Item” to open the Item list.

¶ Alternatively

- Press “CTRL + G” to open the Search Bar.

- Input “Item” and select ITEM LIST.

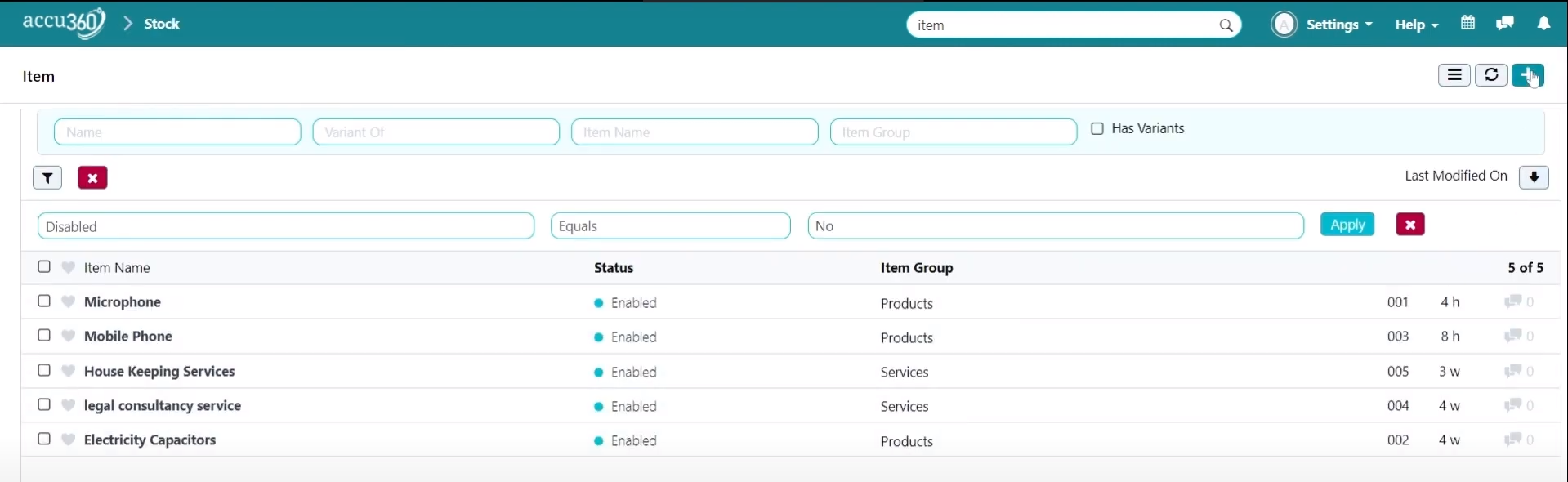

¶ Step 2 - Add a New Item

- Click on the + button to add a New Item.

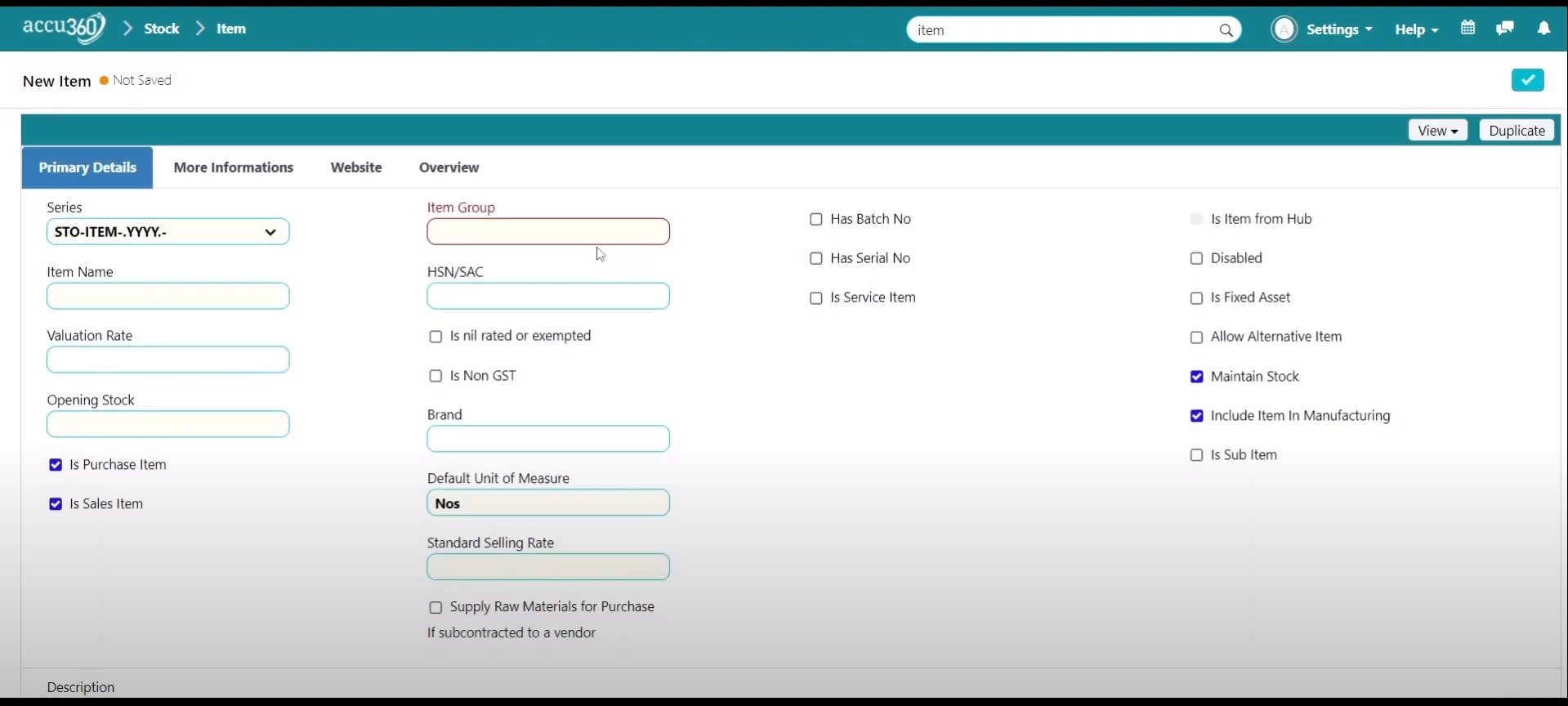

- Add all the necessary details regarding the Item.

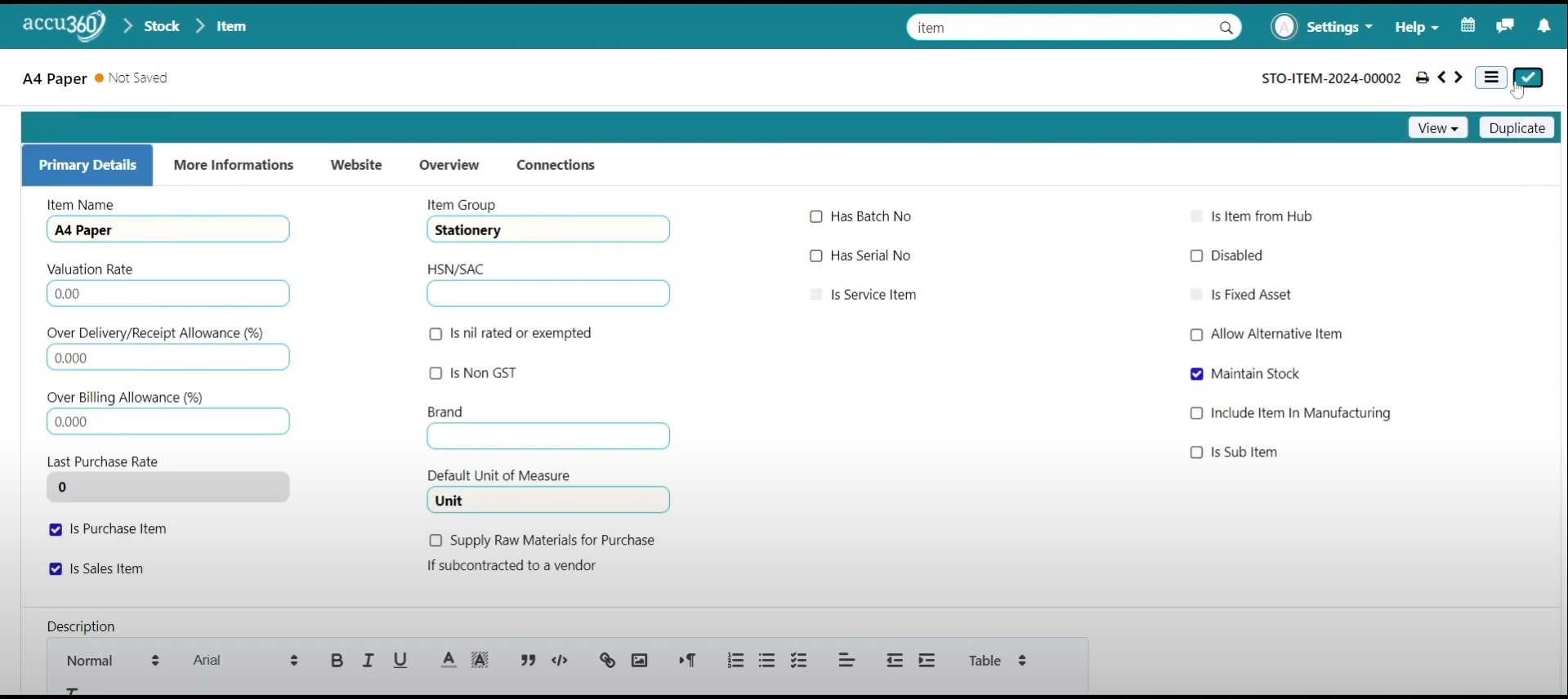

¶ Step 3 - Save the Item

- Click on the “RIGHT TICK” to save.

¶ Necessary Points to be Kept in Mind

-

Valuation Rate: Items can be defined with valuation rates for accounting purposes, but it’s optional for now as there’s no opening stock.

-

HSN and SAC Codes: These are classification codes for goods and services, used for taxation and statistical purposes, ensuring uniformity and ease of taxation compliance.

-

GST Classification: Items can be classified as either “Nil rated or Exempted” or “Non-GST,” depending on their GST status.

-

Brand: Option to create a brand for the item.

-

Unit of Measure: Select the unit for purchasing the item.

-

Standard Selling Rate: Set the selling rate for the item.

-

Supply Raw Materials for Purchase: For items sent to job work, select this option.

-

Batch Number, Serial Number: Check out Other Relevant Documents Section

-

Service Item - If any Services is purchased then this option must be selected

-

Fixed Asset Option: If the item is a fixed asset, click this option.

-

Allow Alternative Items: Set alternative items for stock-out situations.

-

Maintain Stock Option: Include or exclude the item from manufacturing.

-

Is Sub Item Option: Define the item as a sub-item, which means a Part of a Big Item. Example- Seats for a Car.

-

Description: Add a description for the product.

-

Item Tax: Configure item-tax Template specifically for the item.

-

Sales, Purchase, and Accounting Defaults: Set default warehouse, auto-reorder, and add product image.

-

More Information Section: Variants, barcodes, inventory details, purchase replenishment, supplier details, foreign trade details, sales details, and customer details.

-

Website Option: Configure the item that should be available on the website as well.

-

Overview: View all the documentes related to this Item.