¶ Payment Entry

Payment entry docs helps to create payment entries against many Documents in ACCU360 ERP (e.g.Against sales Order, Delivery Note,Sales Invoice, Employees Advance payment etc.). You can use the payment entry doc for both incoming and outgoing payments.

¶ Why to use payment entry form instead of Direct Journal Entries?

In the back-end payment entry document also pass the journal entries. But whenever you use this payment entry document its gives you some more information about the party like total outstanding, against which invoice payment need to be made and how much total outstanding amount

Most importantly you do not have to reconcile payments with invoices manually to match payment invoice wise.

¶ Comprehensive Guide for Creating Payment Entries in ACCU360 ERP:

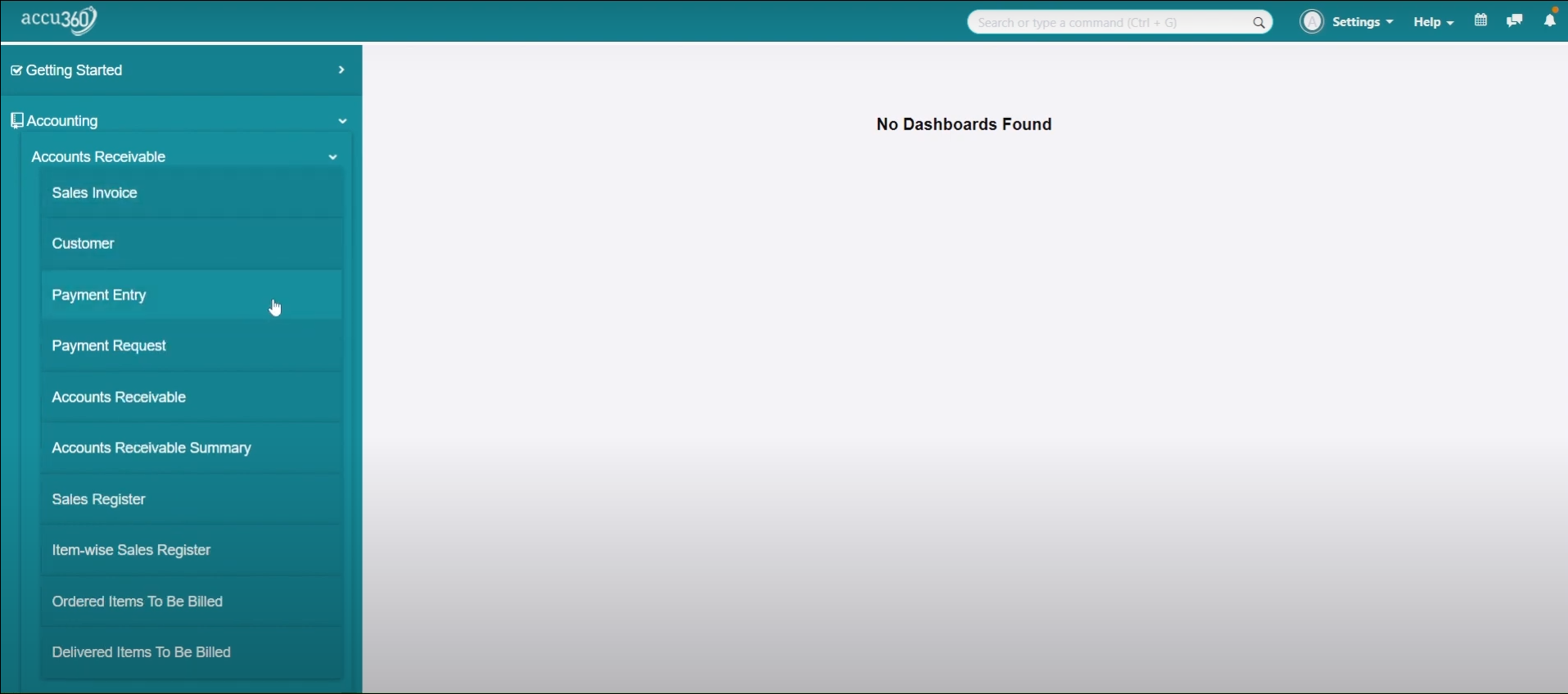

¶ Step - I. Access Payment Entry :

Home < Accounting Module < Accounts Rceivable / Payable < Payment Entry

- Navigate to the Accounting Module.

- Access the Payment Entry section through either “Accounts Payable” or “Accounts Receivable” options.

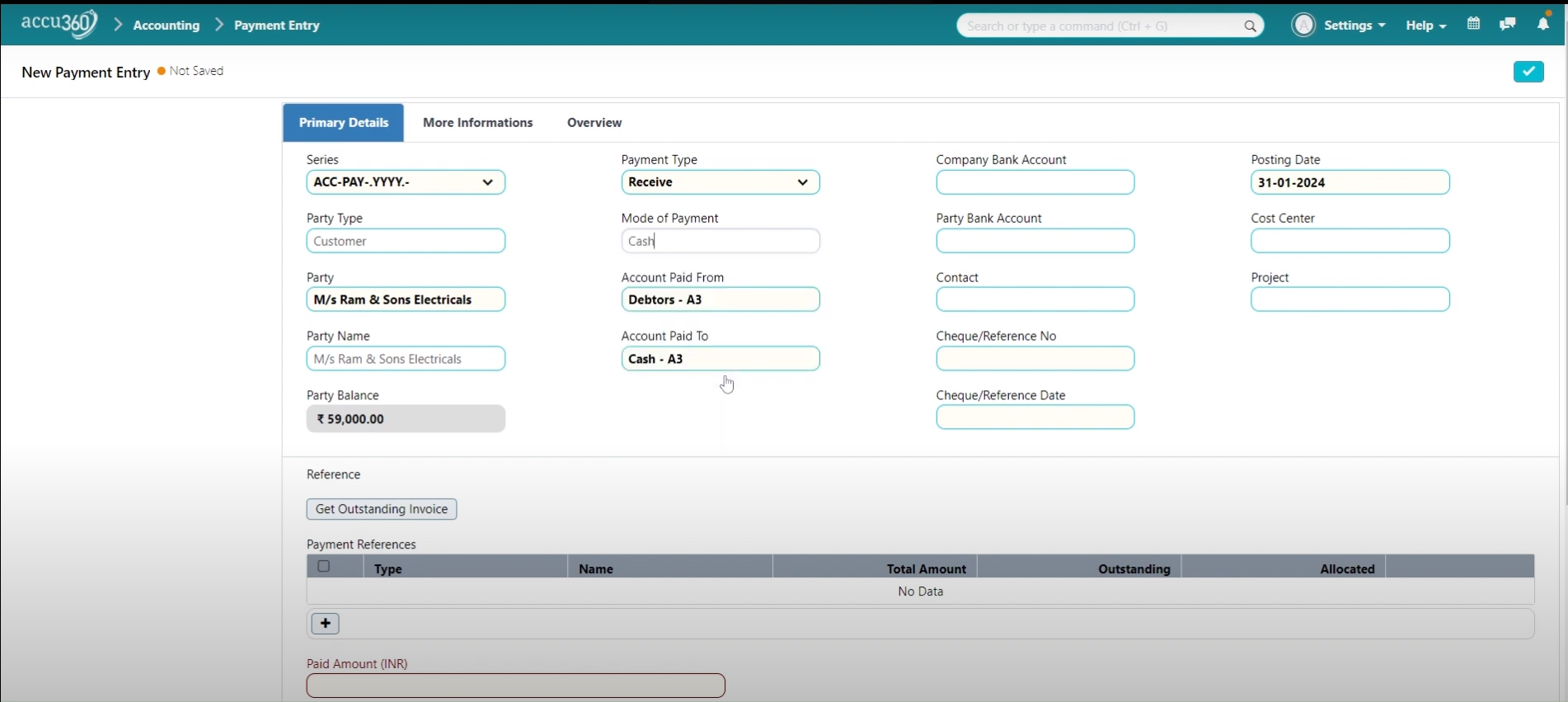

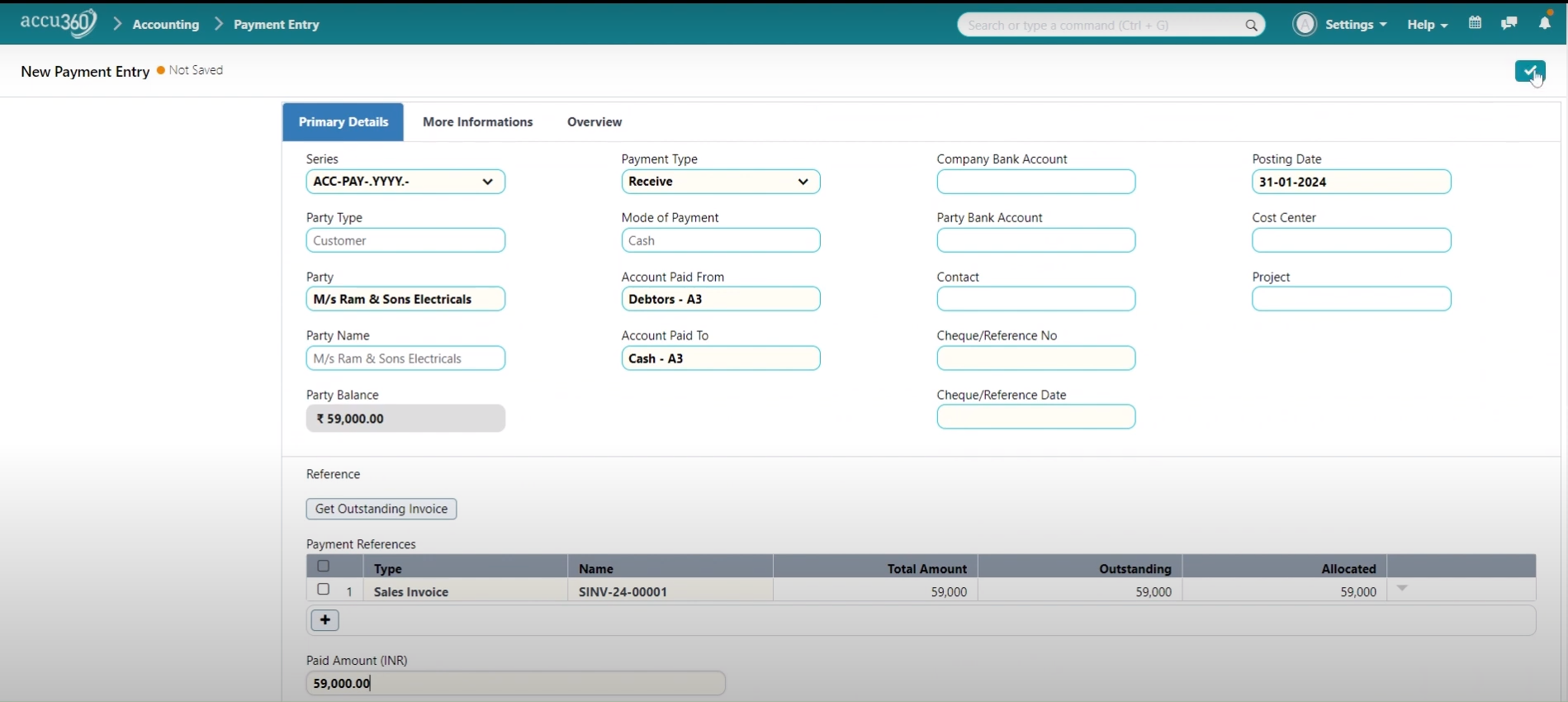

¶ Step II. Select the Party and Payment Mode:

- Identify the Party Type for the Payment Entry (customer, supplier etc).

- Choose the appropriate Party (e.g., M/S RAM & SONS ELECTRICALS).

- Select Payment Type (e.g. Recieve or Paid)

- Select the payment mode (e.g., cash, cheque) based on the transaction details.

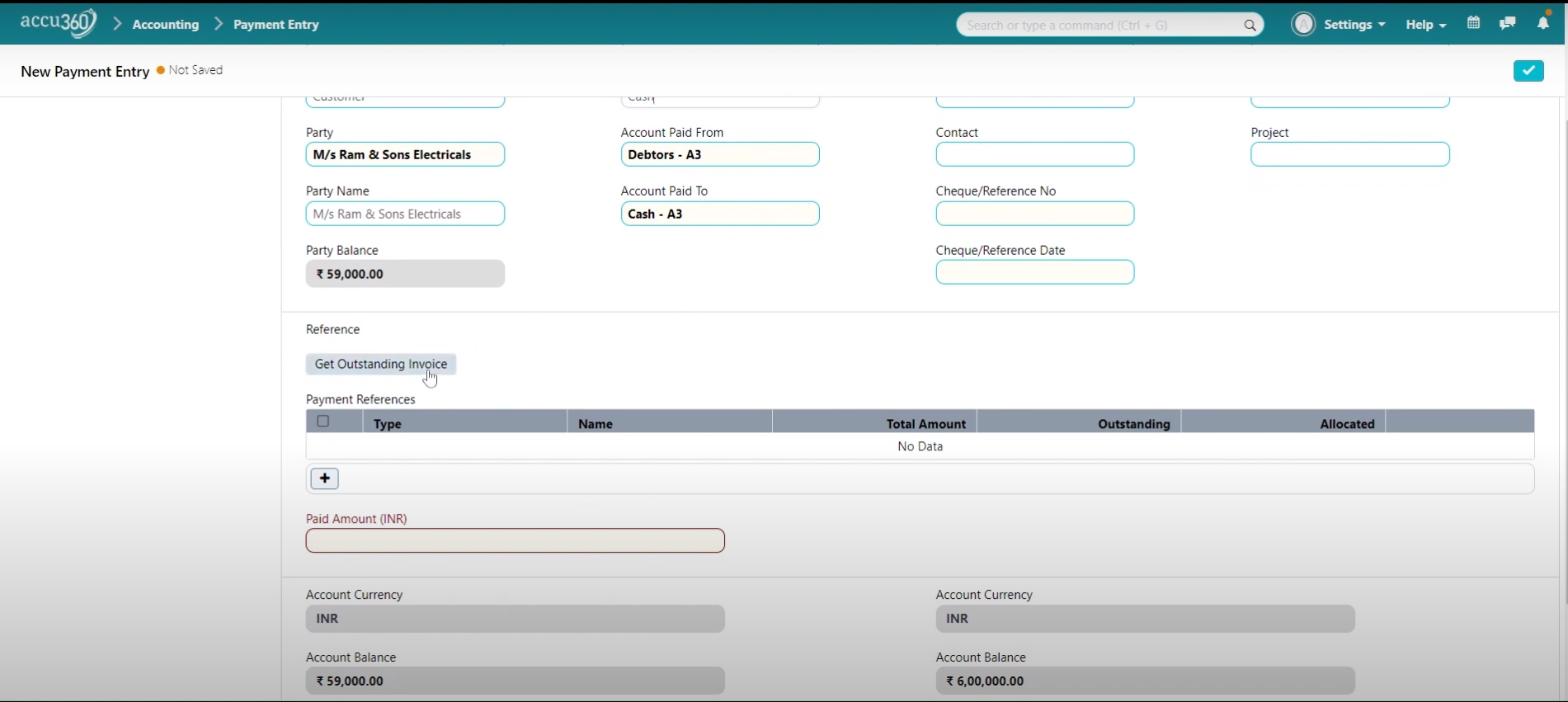

¶ Step III. Retrieve Outstanding Invoices:

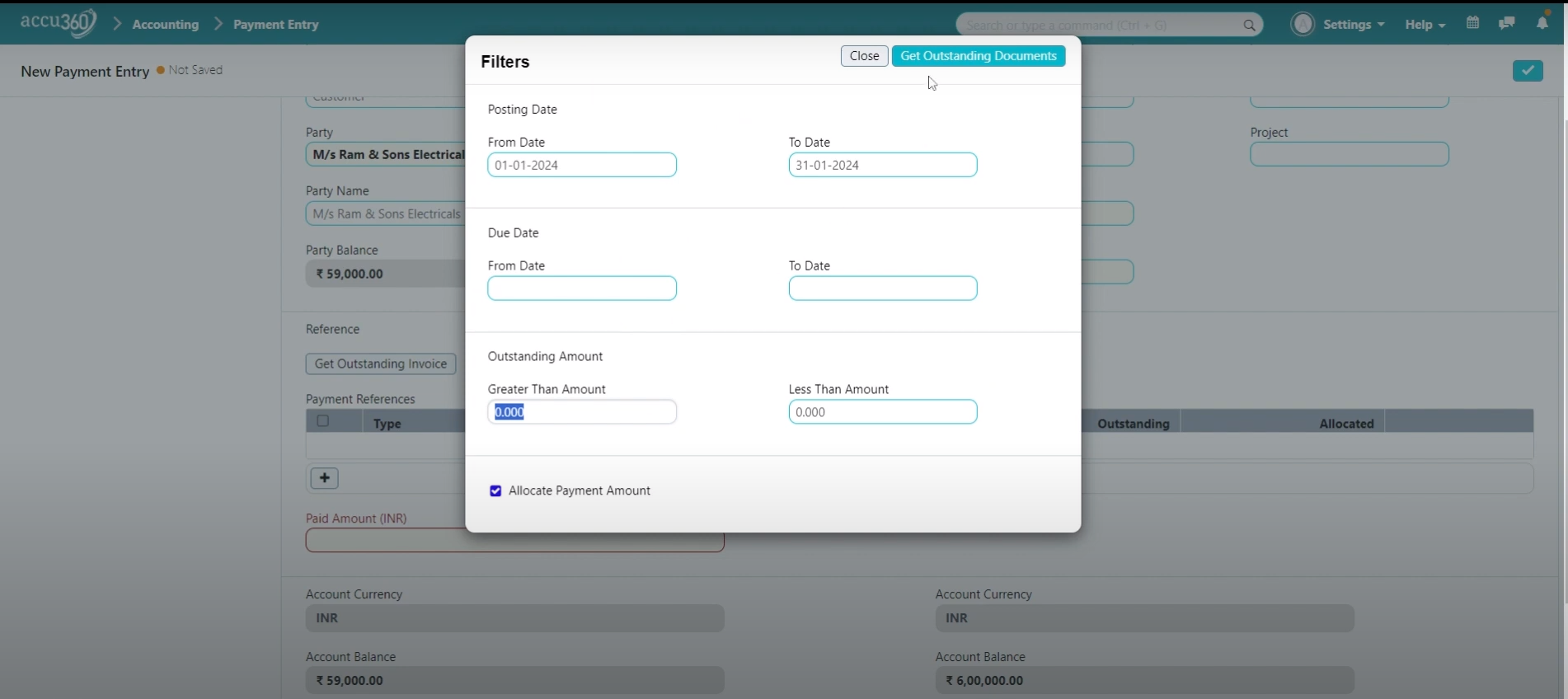

- Use the “Get Outstanding Invoice” feature to retrieve all outstanding invoices related to the selected party.

A pop-up window will appear, Apply Filters on the invoices based on parameters like posting date, due date, or outstanding date & Click on “GET OUTSTANDING DOCUMENTS”

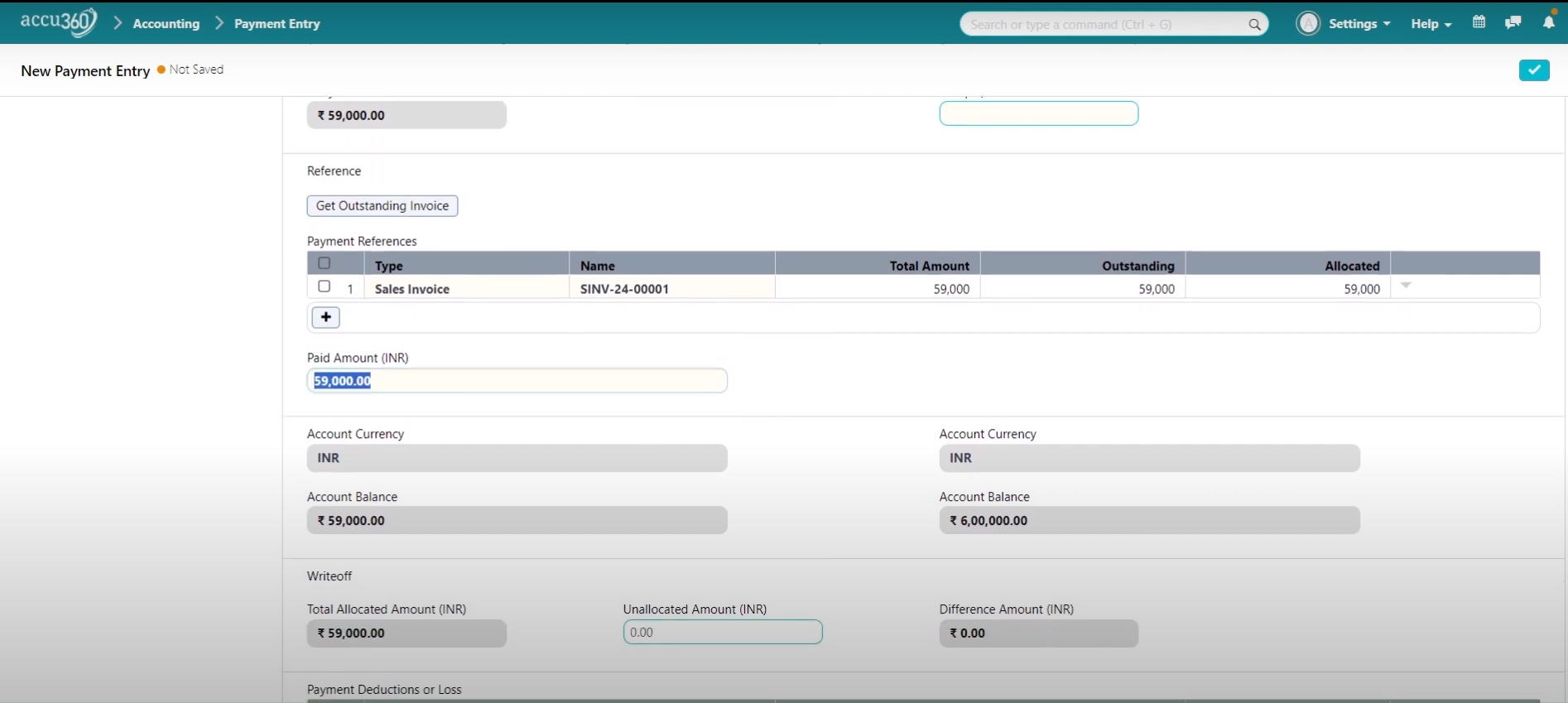

¶ Step IV. Enter Payment Details:

- Enter the amount to be paid or received , ensuring it matches the invoice or settlement amount.

- Fill in any required fields such as cheque reference number and in case of Bank Transaction.

¶ Step V. Save Payment Entry:

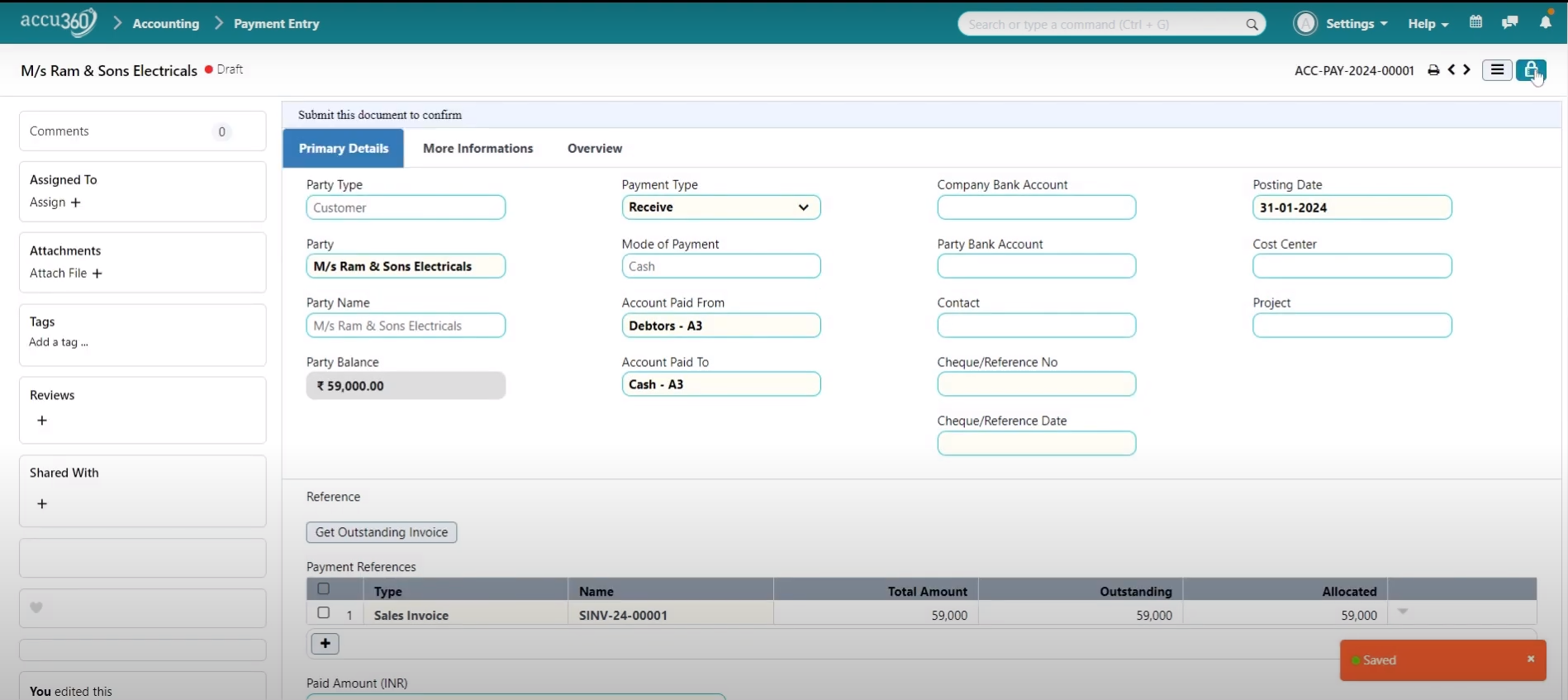

- Review the payment entry details for accuracy.

- Click on the “Save” or “Tick” button to save the payment entry.

Confirm the payment entry submission. Click on the “Lock” button to permanently submit the payment entry.

¶ Verify Payment Status:

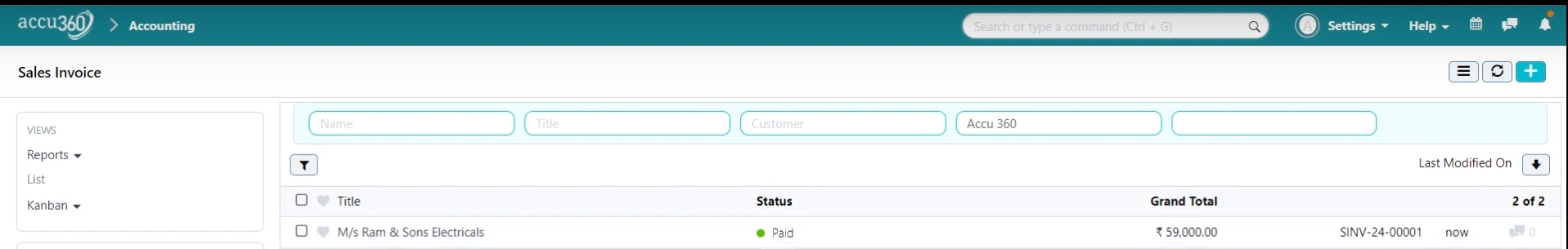

- Check the status of invoices to ensure they reflect the payment made.

- Verify that the payment entry has successfully updated the payment status of the corresponding invoices.

¶ Additional Notes:

- Payment entries can be made for both incoming and outgoing transactions.

- Utilize the user-friendly interface of ACCU360 ERP’s payment entry module for easier navigation and data entry.

- Modify payment entries as necessary, such as adjusting amounts or adding specific details like check reference numbers.

- Ensure compliance with mandatory fields, especially for bank transactions, to avoid errors during submission.

¶ Payment Entry Creation Through an Existing Document

-

Access the Document in whose respect the entry needs to be pass :

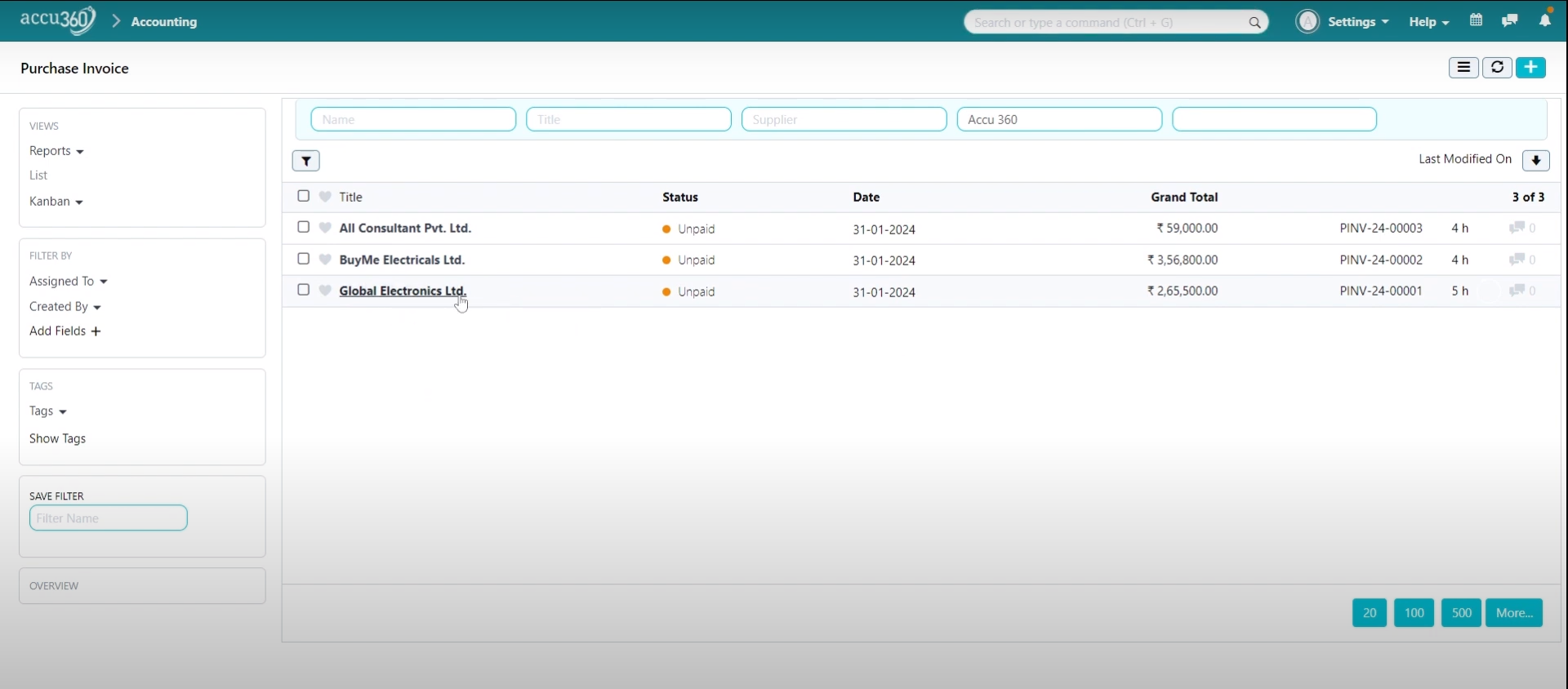

- For e.g. Navigate to the Purchase Invoice list.

- Click on the specific Purchase Invoice in this e.g. Global Electronics Limited.

-

Create Payment Entry:

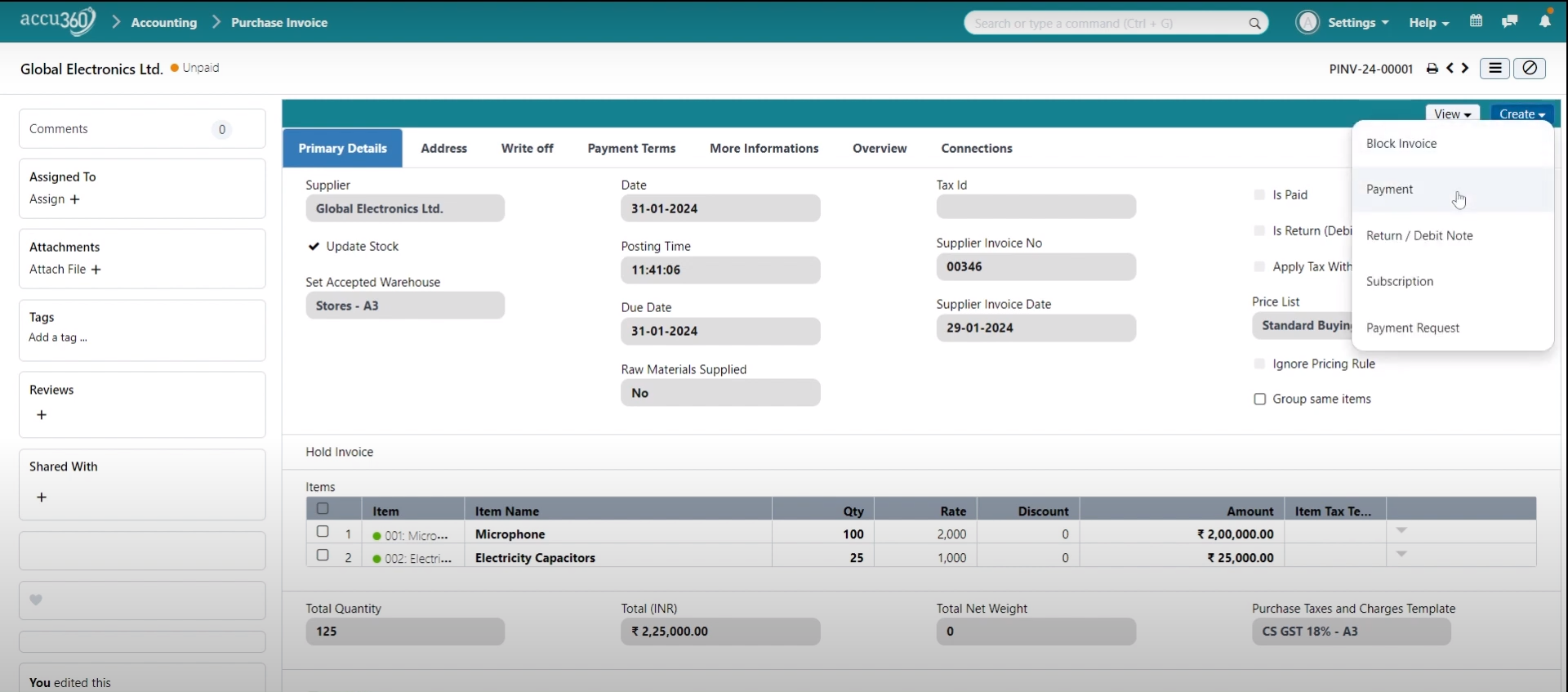

- Click on the “Create” button.

- Select “Payment” from the options.

-

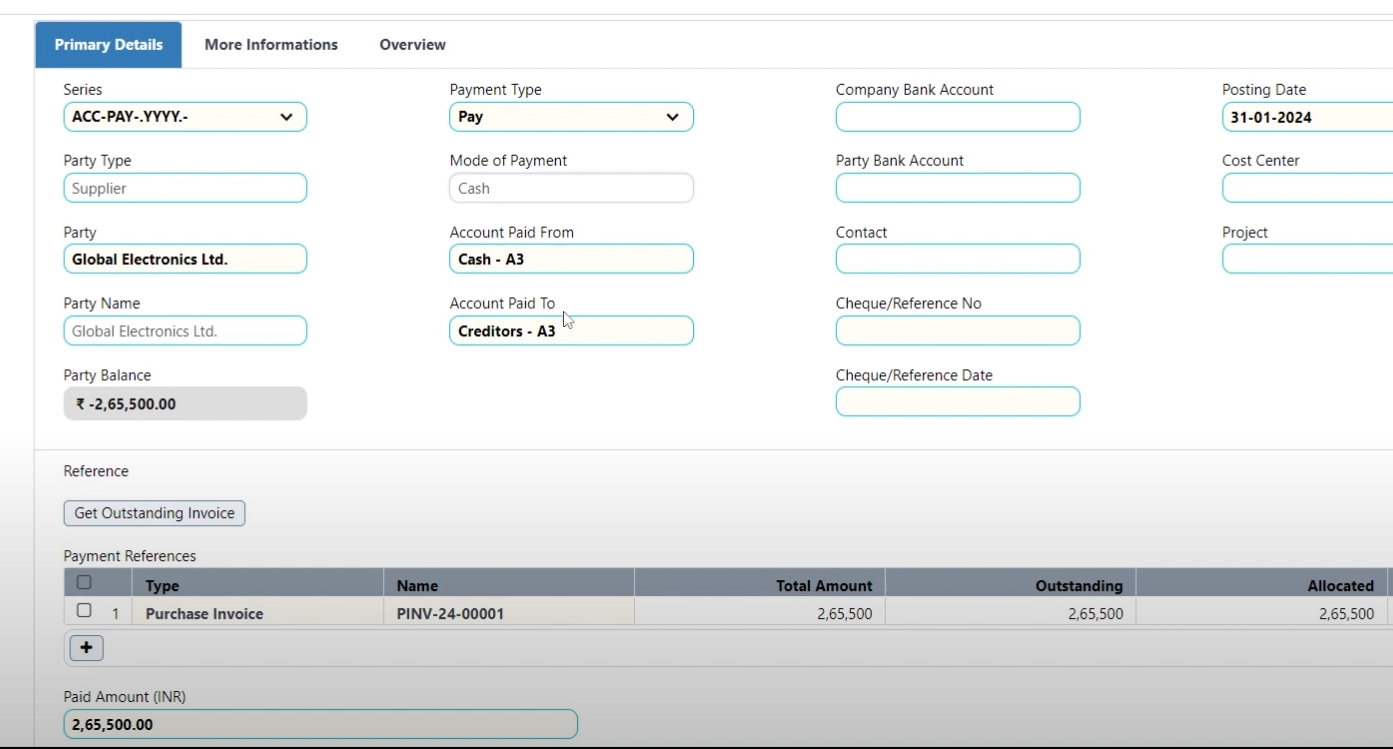

Select Payment Mode and Amount:

- Choose the payment mode (e.g., cash).

- The payment entry is autofilled.

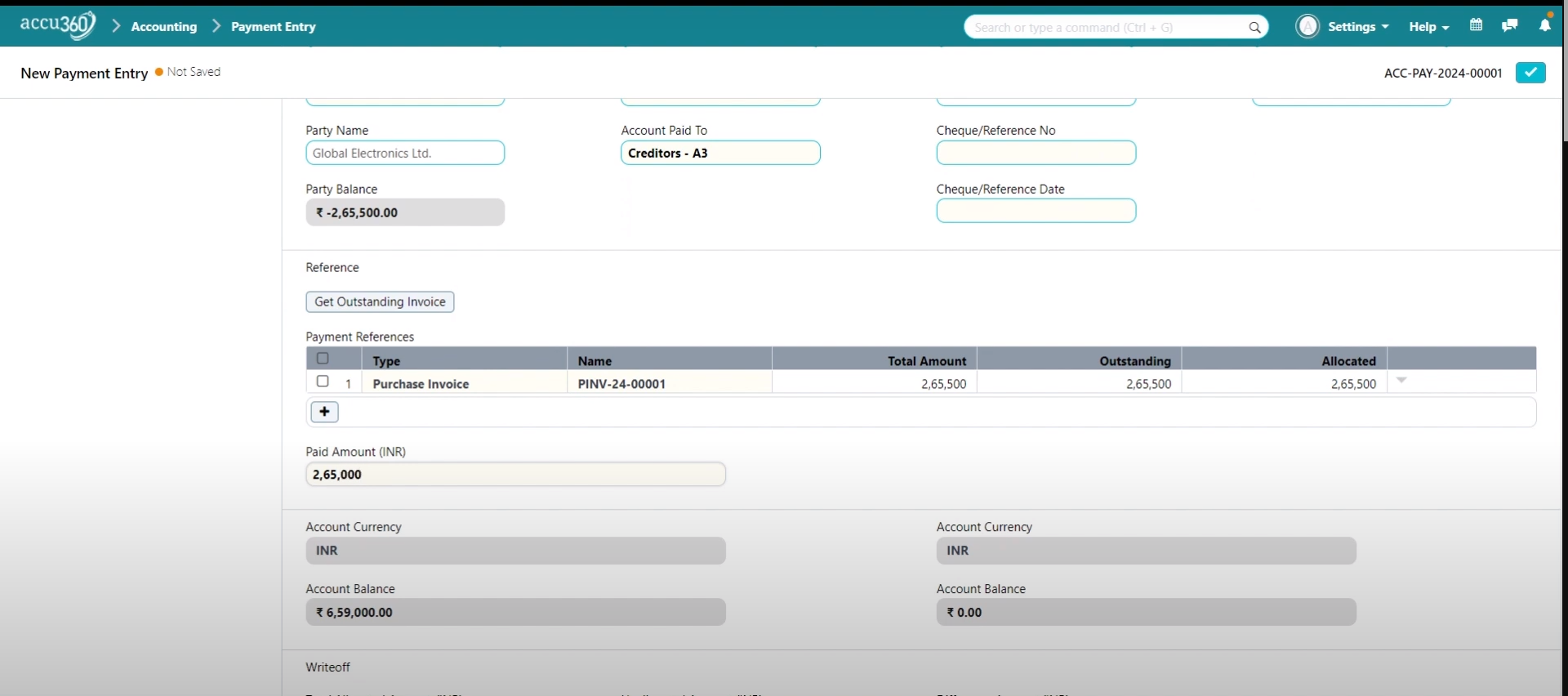

- Adjust the payment amount to match the amount paid (Here, 2,65,000).

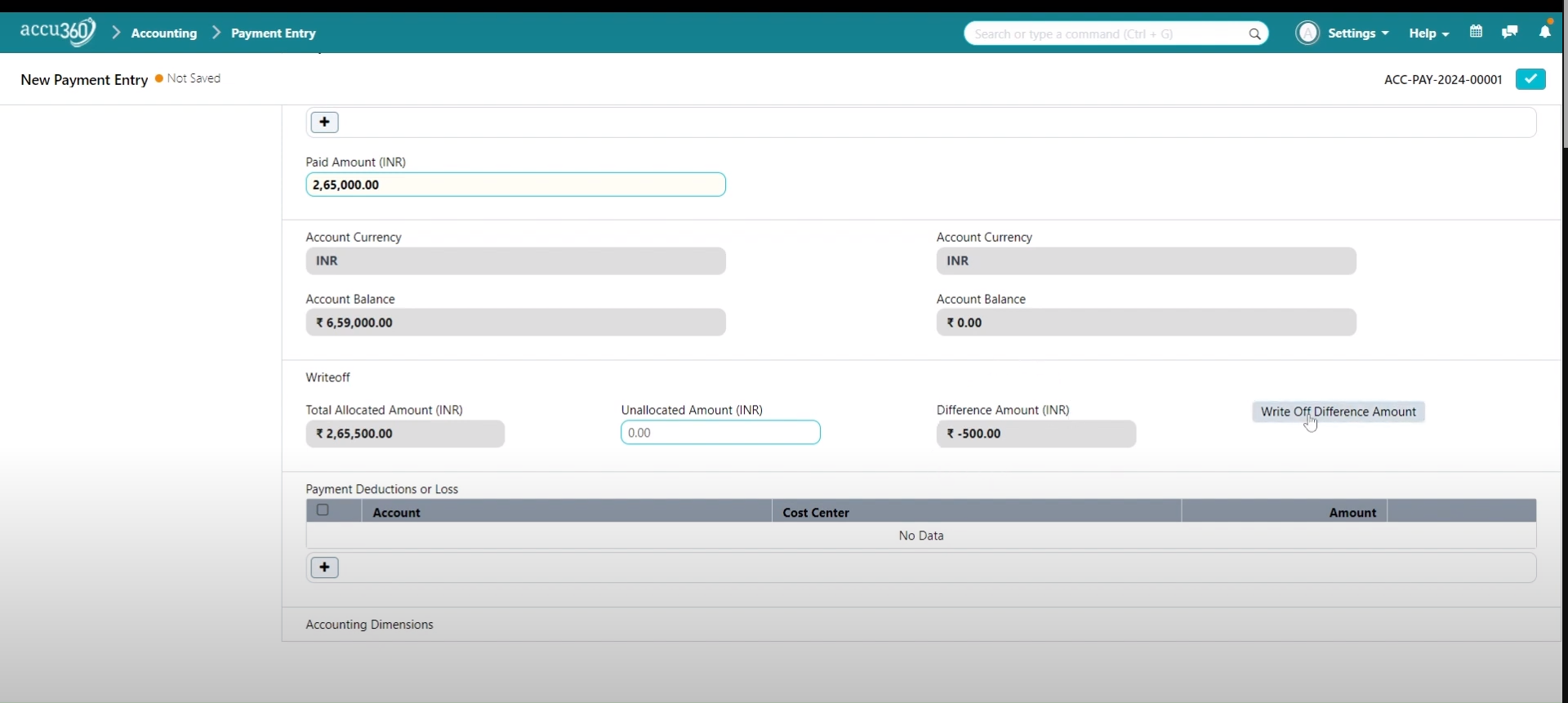

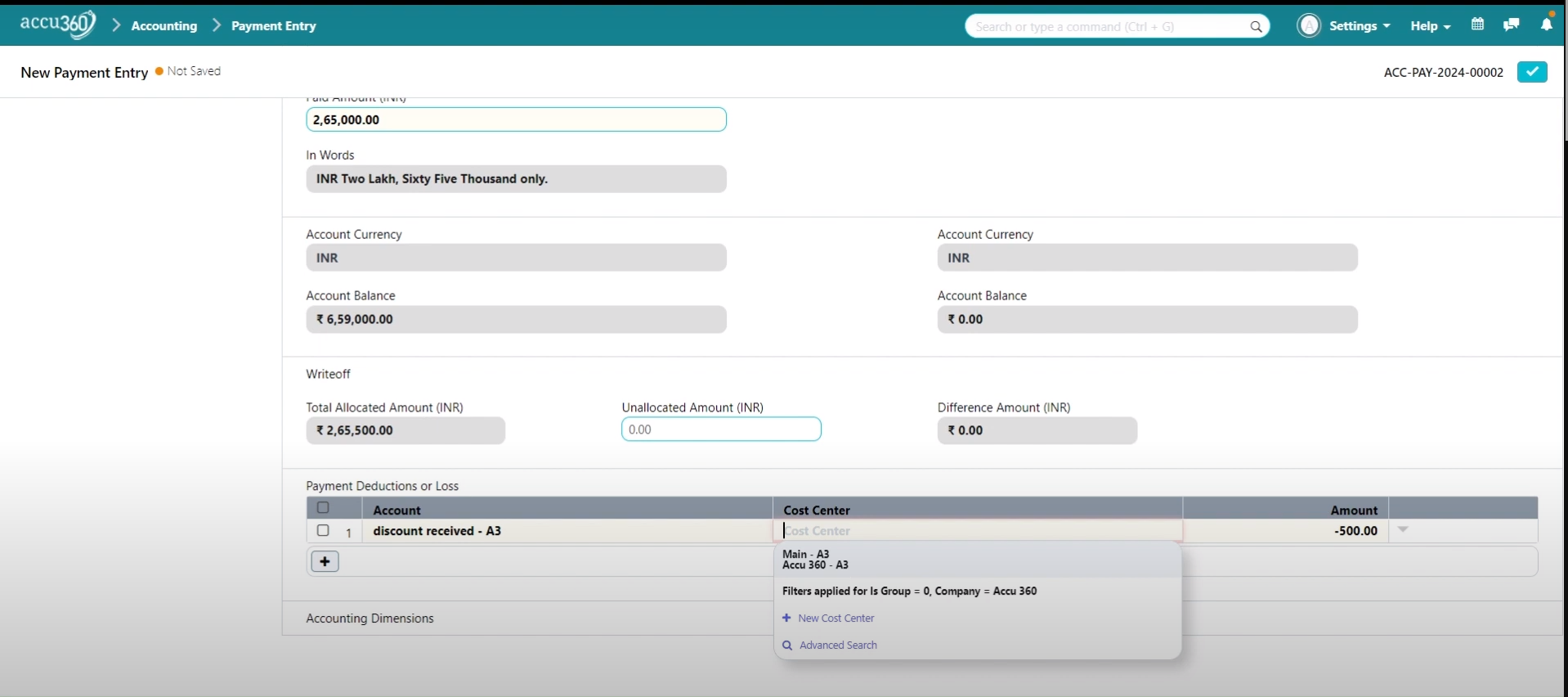

¶ Write Off the Diffenece

- Write off the Difference in the entry

- Click on the WRITE OFF DIFFENECE AMOUNT

- Select the appropriate account

- Save & Permanently Submit the Payment Entry:

- Save the Payment entry by clicking on Right Tick and Lock to Pemanently submit the payment entry.