¶ Item Tax Template

The Item Tax Template is used to charge different taxes on different items whether you are creating a document related to Purchase Process or Sales Process, the Item Tax Template allows you define Taxes on different items separately.

It’s also used to define a particular tax rate on a given Item, which whenever added could automatically be picked up by the system itself.

Prerequisites

¶ Comprehensive Guide For Initial Item Tax Template Setup

-

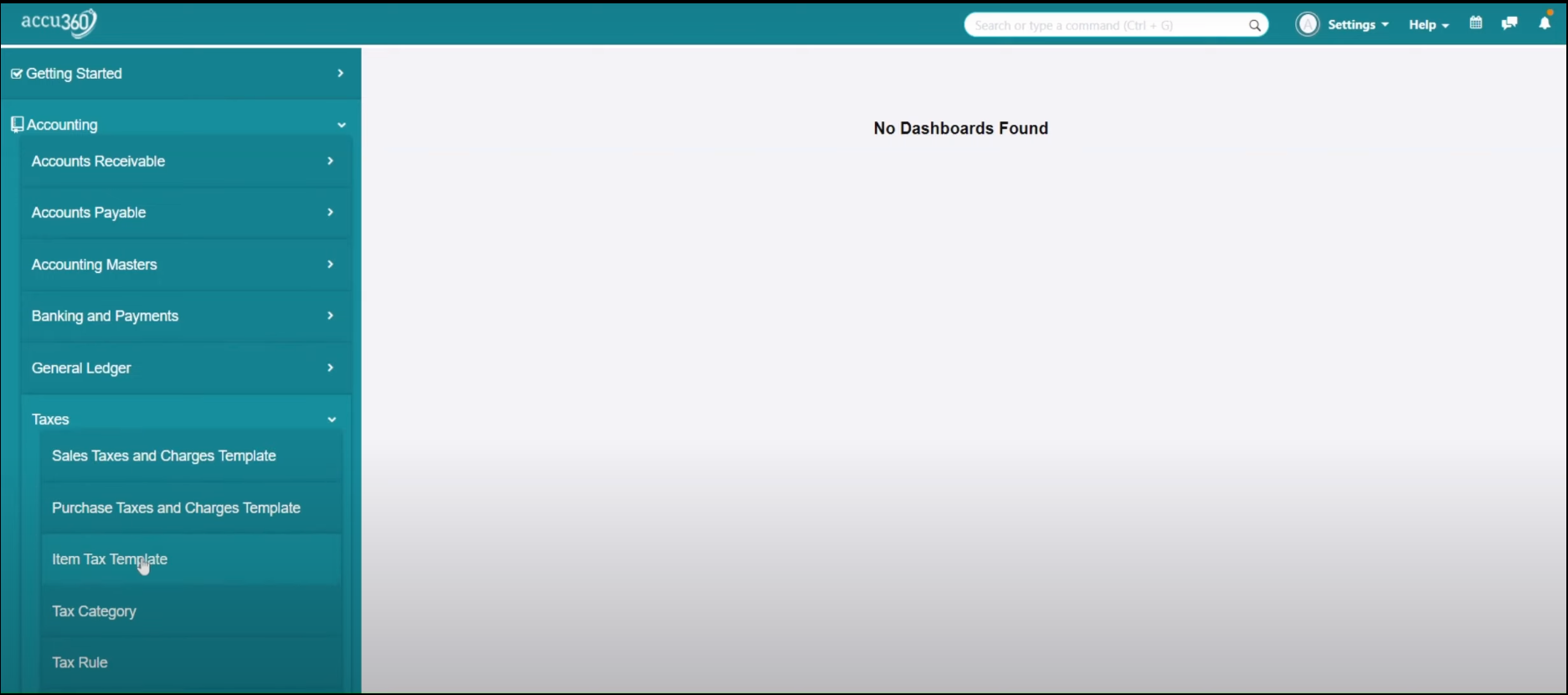

¶ Step I - Access Item Tax Template

Go to Accounting Module < Click Taxes < Select Item Tax Template

-

¶ Step II - Add New Item Tax Template

Click on the “+” Icon in the Right Corner to add new Item tax template

-

¶ Step III - Define all the item taxes

Here we are using separate ledgers for both Purchase & Sales that’s why we have to define separate templates for both Purchase & Sales

Alternatively, if you are using a single ledger for both Purchase & Sales then in that case you may define a single Item tax template for both Purchase & sales.

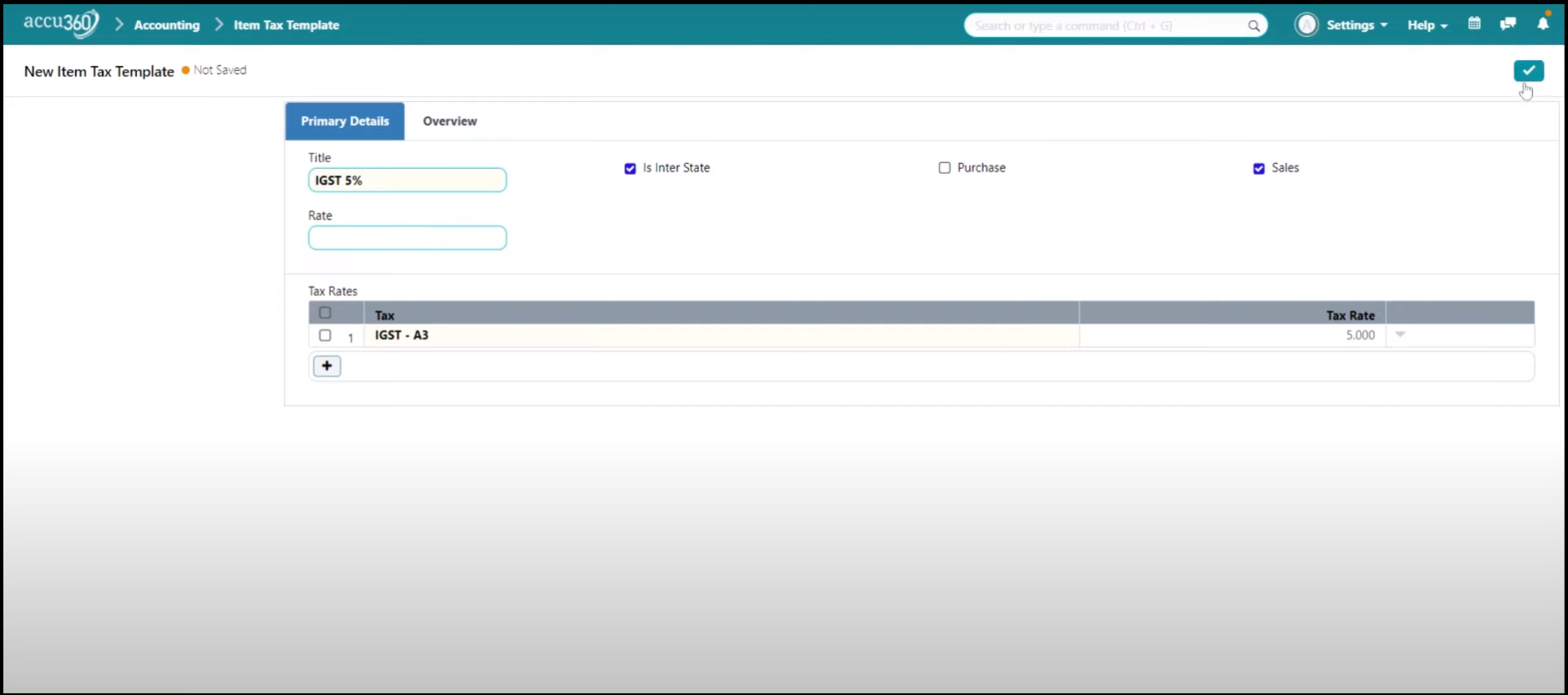

¶ - Case I - Item Tax Template for Sales (Inter State)

Give Name in “Title” for example - IGST 5%

Selct “Is Inter State” option

Select “Sales” Option & define the ledger under the “TAX” Option in the Given example we select IGST

Mention rate of tax under “TAX RATE” in this case 5%

Click on the Right Tick To save

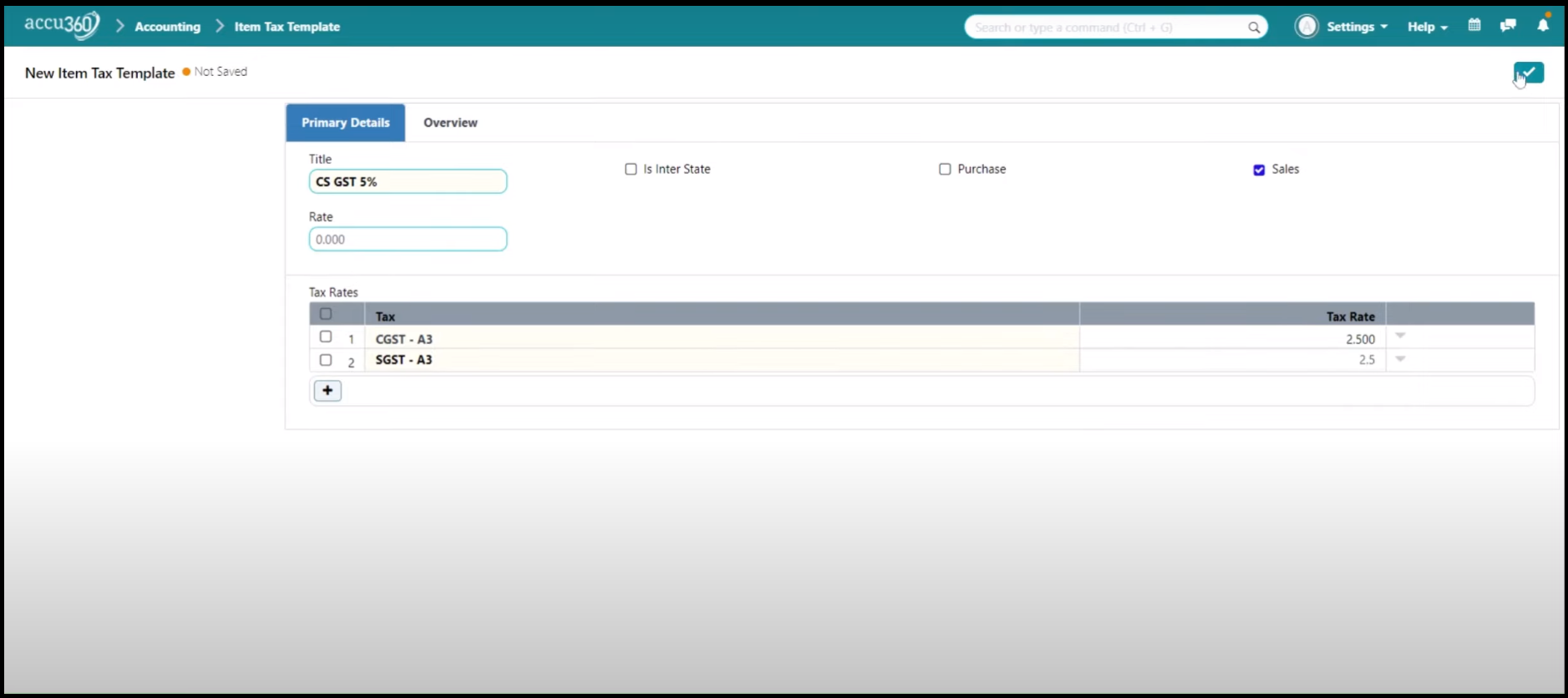

¶ - Case II - Item Tax Template for Sales (Intra State)

Give Name in “Title” for example - CSGST 5%

Do not Selct “Is Inter State” option this time, as it is an Intra State Transaction

Select “Sales” Option & define the ledger under the “TAX” Option in the Given example we select CGST & SGST

Mention rate of tax under “TAX RATE” in this case 2.5% for Both CGST & SGST

Click on the Right Tick To save

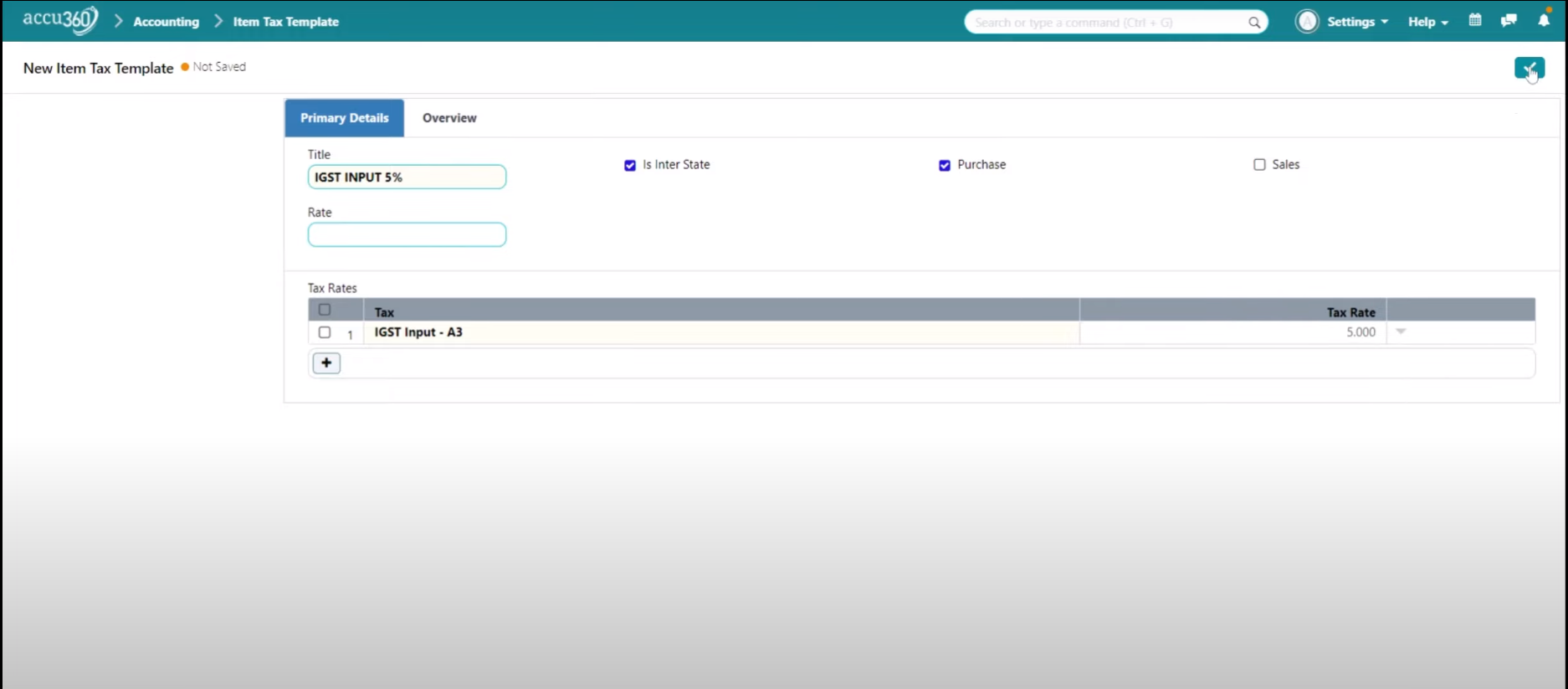

¶ - Case III - Item Tax Template for Purchase (Inter State)

Give Name in “Title” for example - IGST Input 5%

Selct “Is Inter State” option

Select “Purchase” Option & define the ledger under the “TAX” Option in the Given example we select IGST Input

Mention rate of tax under “TAX RATE” in this case 5%

Click on the Right Tick To save

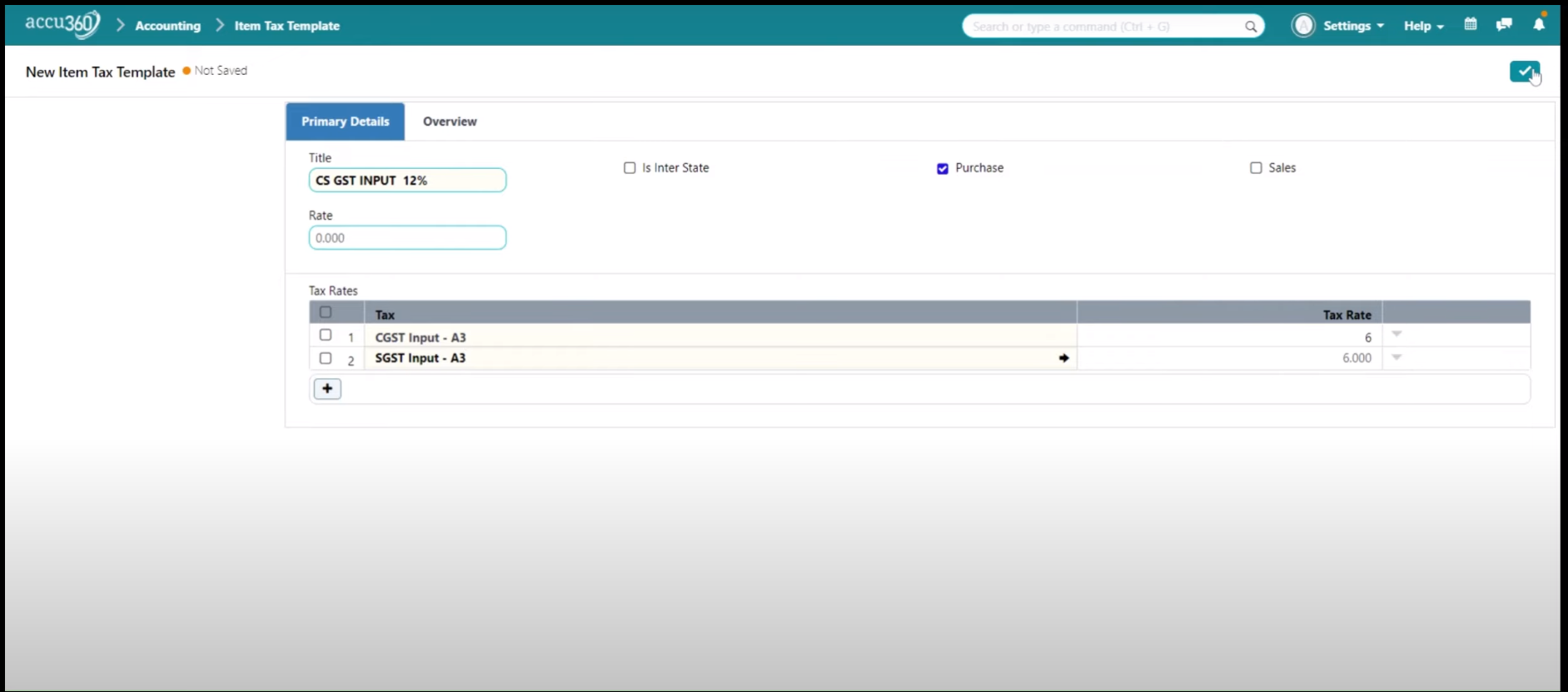

¶ - Case IV - Item Tax Template for Purchase (Intra State)

Give Name in “Title” for example - CSGST Input 12%

Do not Selct “Is Inter State” option this time, as it is an Intra State Transaction

Select “Purchase” Option & define the ledger under the “TAX” Option in the Given example we select CGST Input & SGST Input

Mention rate of tax under “TAX RATE” in this case 6% for Both CGST & SGST

Click on the Right Tick To save