¶ Inventory Reconciliation

Stock Reconsiliation is used for two(2) purpose one is for Stock Reconciliation and Second is for Opening Balance of Stock.

Navigation : Stock > Stock Reconciliation

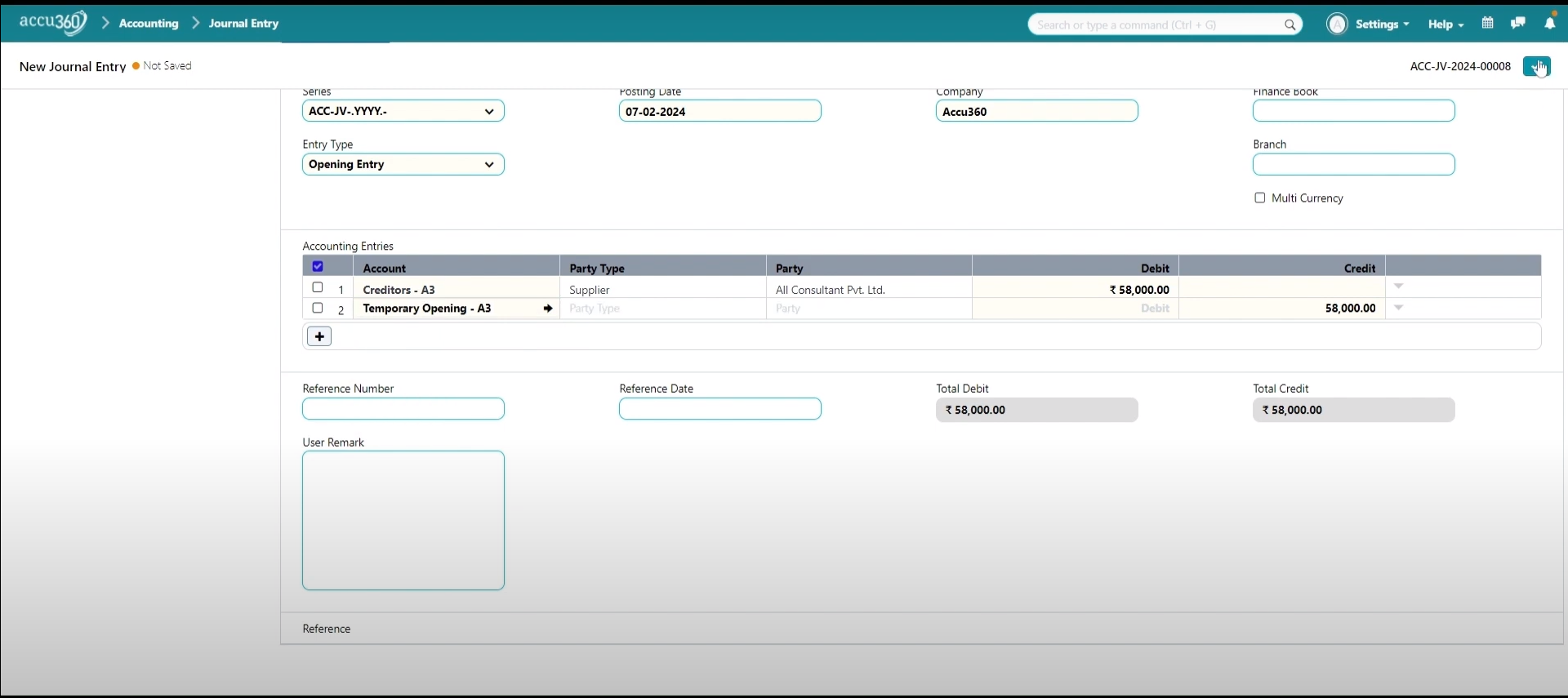

¶ Image of Stock Reconciliation Doc

1.Purpose: Select Opening Stock if you want to pass stock opening. Select Stock Reconciliation if it is for Stock Reconciliation.

2.Difference Account: Depending on your purpose system will automatically determine account you can also select your own ledger.

3.Posting Date: Select date for which date you are passing Opening or Stock Reconciliation.

4.Branch If you are using multi branch then select the branch for which you are passing Opening or Stock Reconciliation

Note: You cannot choose Income Or Expense Account in Opening Balance.

Keep other data as it is or only change if required.

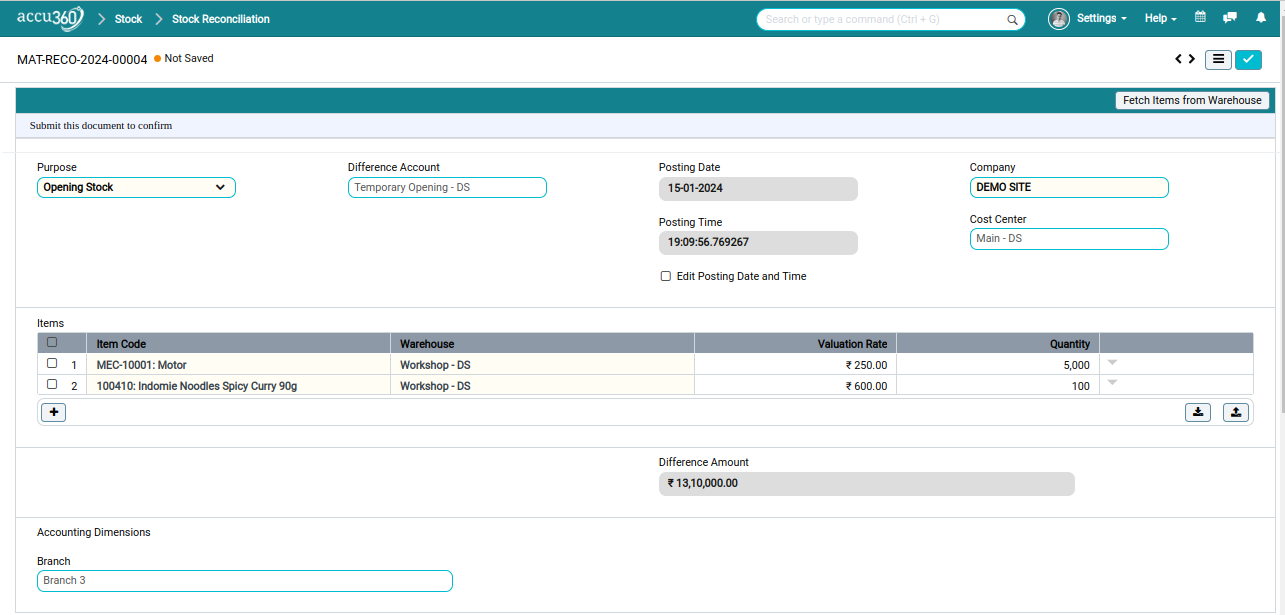

¶ Transaction Ledger Effect.

Effect of Above entry.

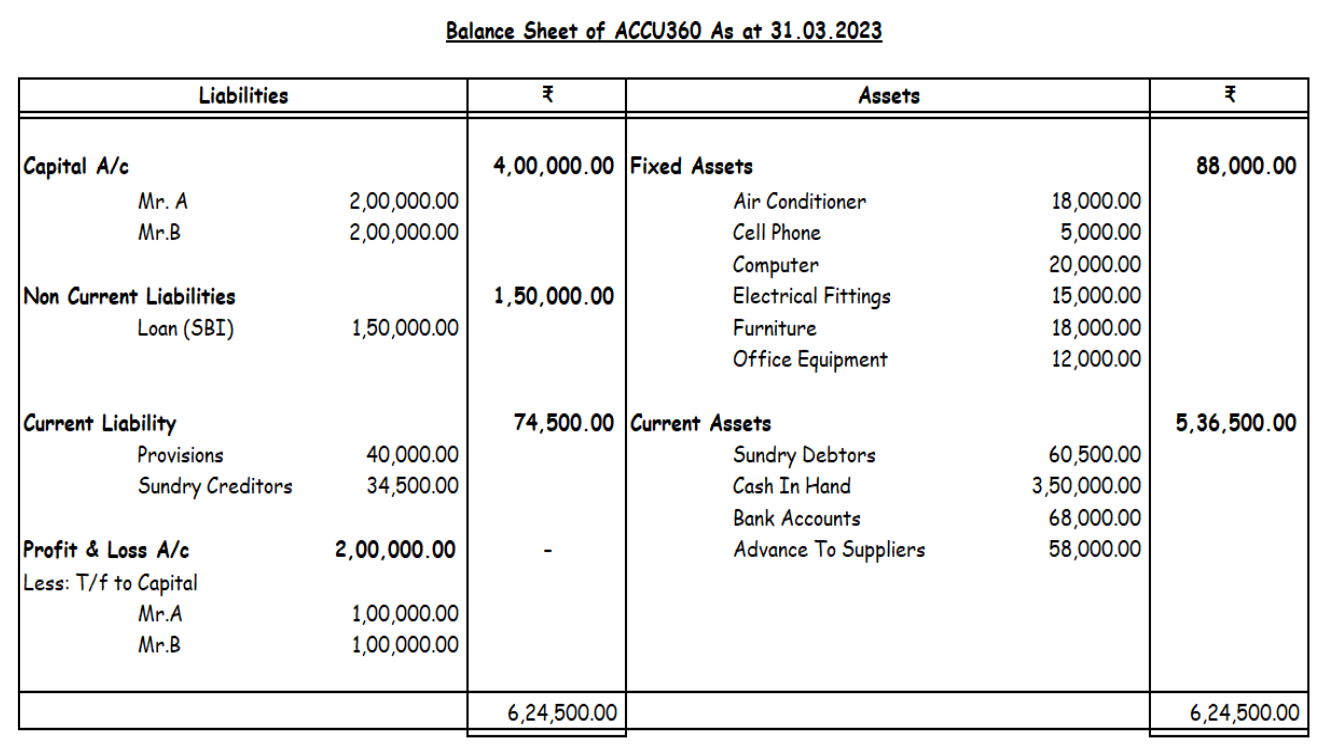

¶ Opening Balances

As many Businesses might already be conducting the business operations and saving our data in various places like multiple spreadsheets or small accounting and billing softwares. But now, to streamline our business processes, wants to migrate all existing data to ACCU360 ERP. They would have multiple ledgers in the old books of accounts, and those ledgers may have outstanding balances. Now, to bring all those ledgers to ACCU360 ERP, they have to enter the opening entry and bring all the necessary ledgers having outstanding balances."

"Please Note that opening entries are not relevant to a business which is started new, where all the entries are entered from scratch in ACCU360 ERP only.

-

¶ Prerequisites

¶ Comprehensive Guide Opening Balances

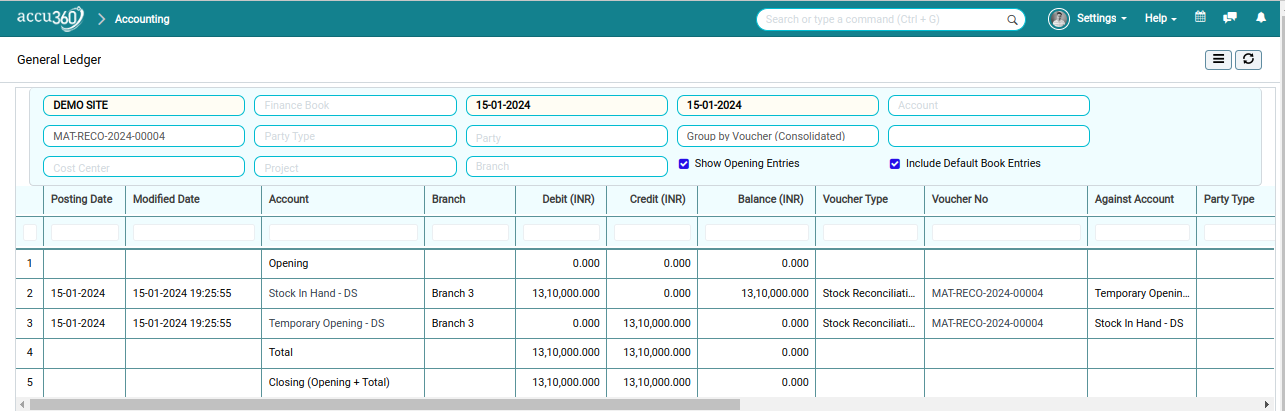

¶ Sample Balance sheet to be Incorporated

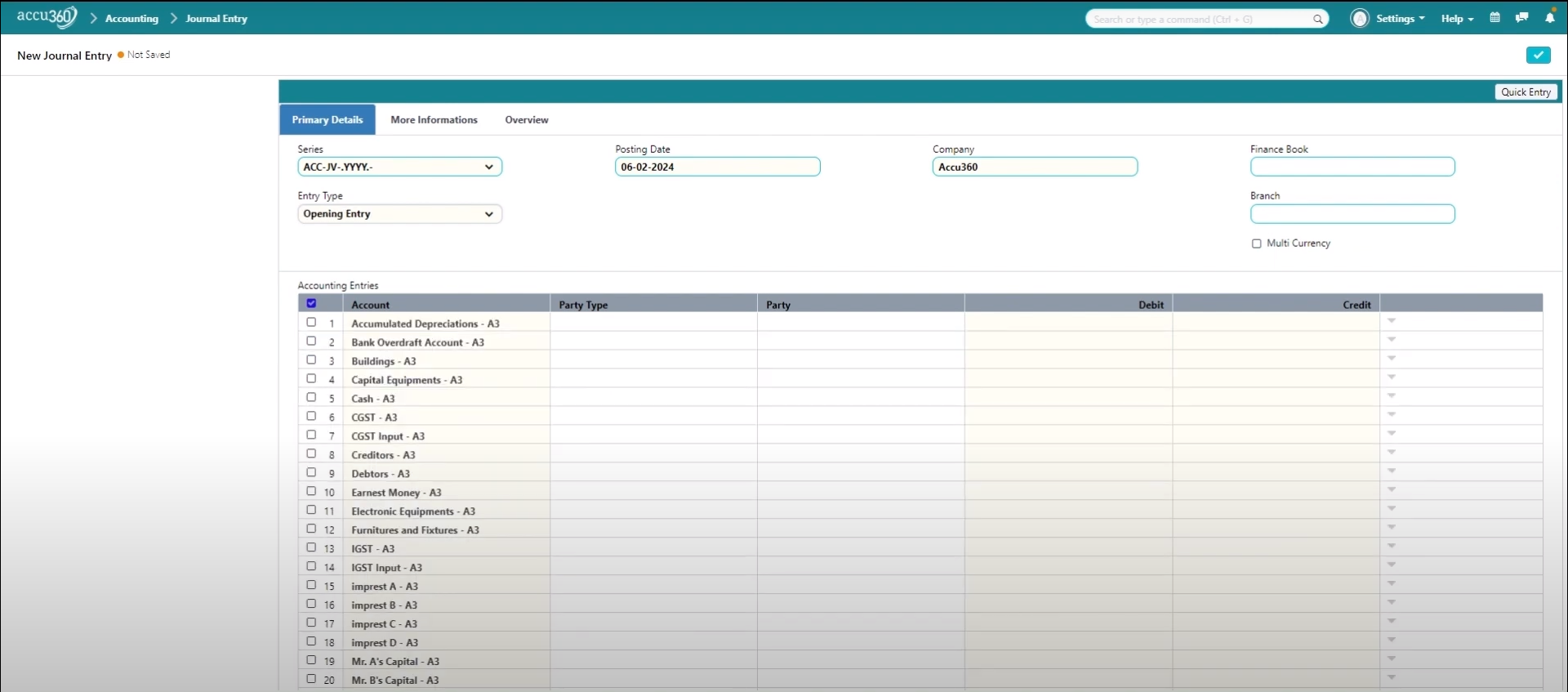

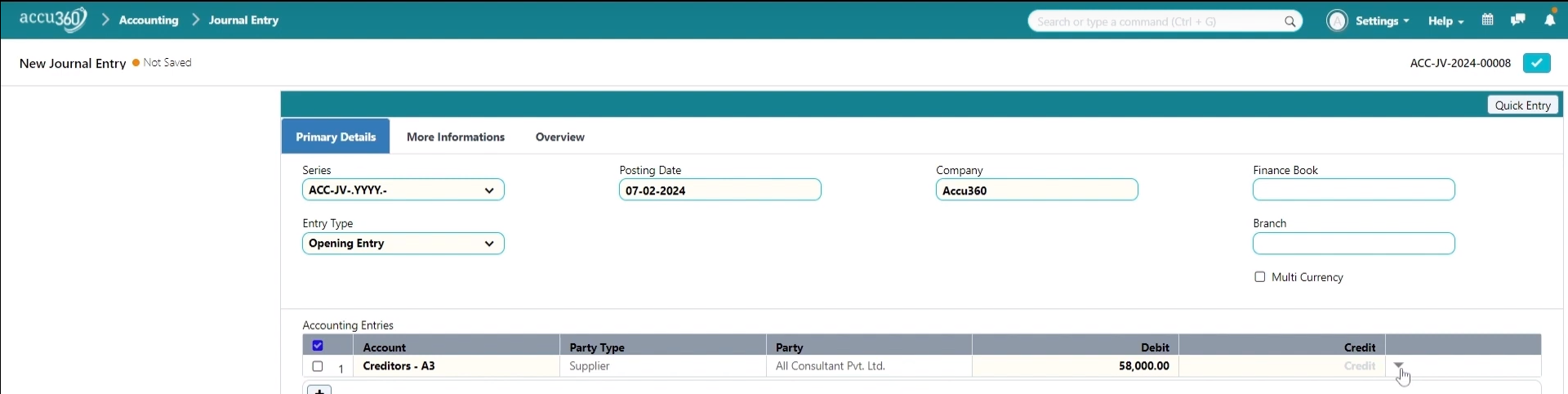

¶ Step I Access the Journal Entry & Select Opening Entry

-

Navigate to Journal Entry: Access the Journal Entry section in ACCU360 ERP where you can input financial transactions.

-

Add a New Journal Entry: Start by adding a new journal.

-

Select Entry Type: Make sure to select the entry type as “Opening Entry”. This distinguishes it from regular journal entries.

¶ Step II Select Relevant Ledgers & Add Balancces

-

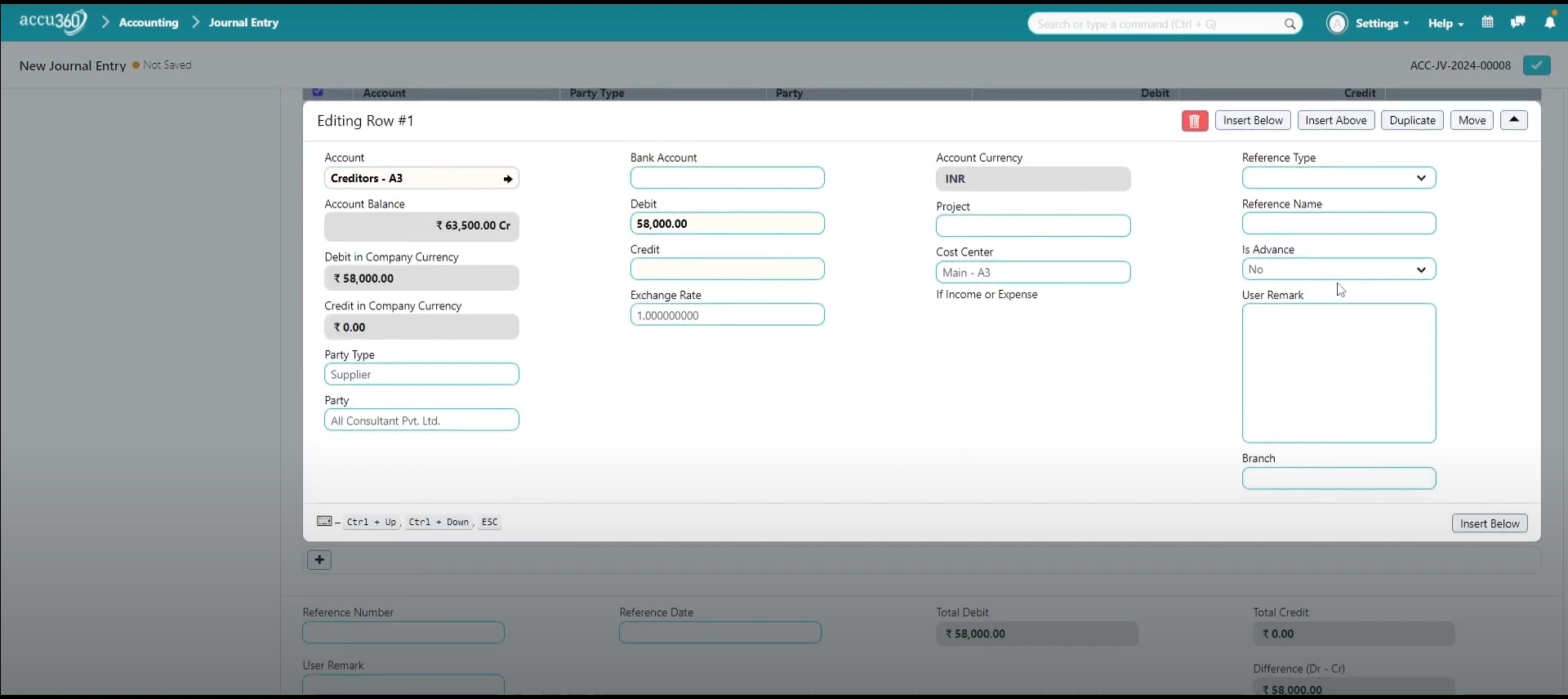

Add Ledgers: Add each ledger separately, ensuring all necessary accounts are included. You may have to create new accounts if they don’t already exist in the system.

-

Enter Amounts: Enter the appropriate amounts for each ledger. Pay close attention to whether each amount should be a debit or credit.

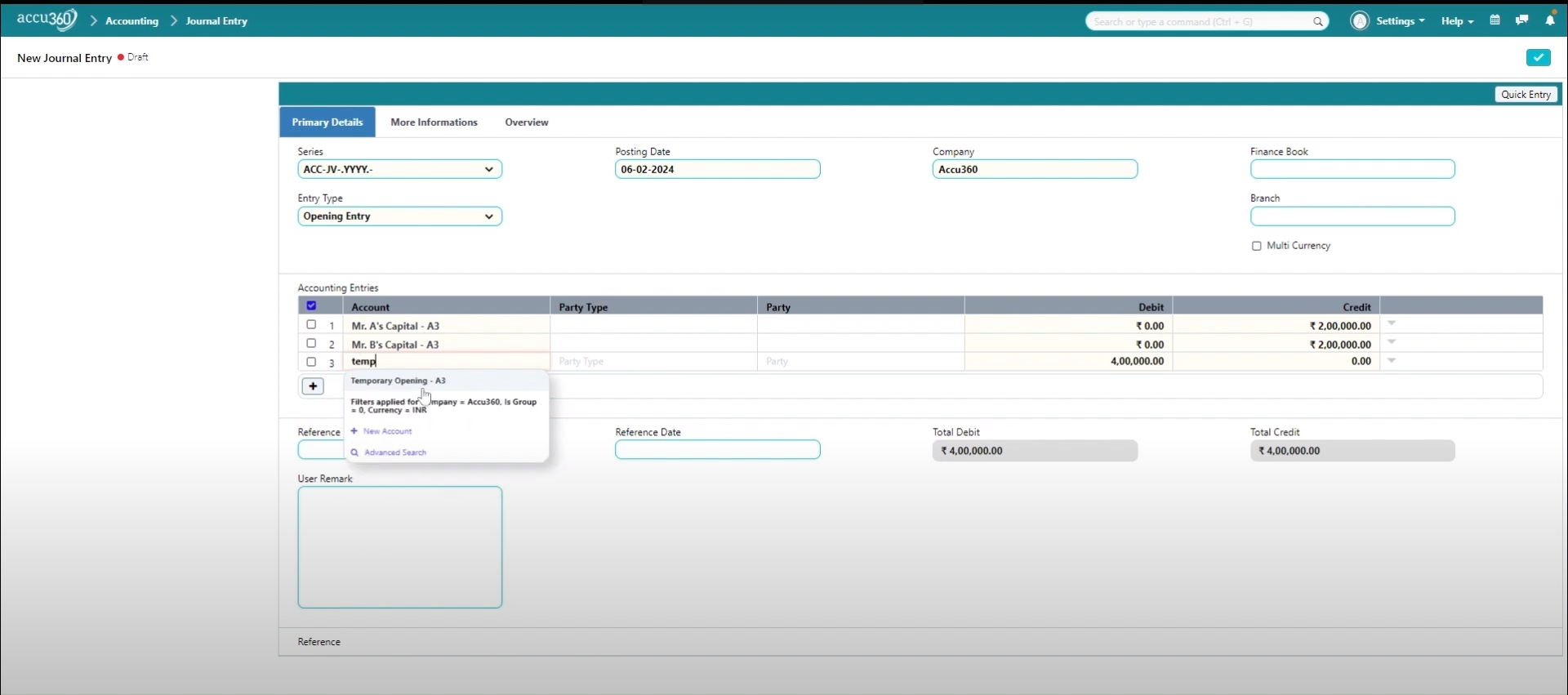

¶ Step III Use of Temporary Account

- Use Temporary Opening Account: When making difference entries to balance the transaction, select the temporary opening account. This account helps keep track of the total opening balances entered.

Please note that Temporary Opening Account is a temporary account and there should not be any balance left in this Account once you have entred all the opening balances. It is used to match the dual effect of Accounting i.e. Debut & Credit.

If the Balance of Temporary account is left either debit or credit side it means the old books of accounts are not closed properly and there is a need to check the Old Books of Accounts.

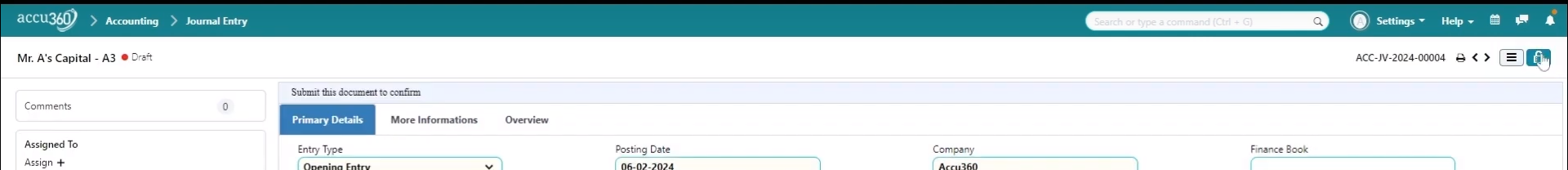

¶ Step IV. Save & Permanently Submit

- Save and Permanently Submit: Once all the entries are correctly inputted, save the journal entry.

Verify the correctness of the entries before permanently submitting them.

- Continue with Remaining Entries: Proceed to pass the remaining opening entries, following the same process outlined above for each.

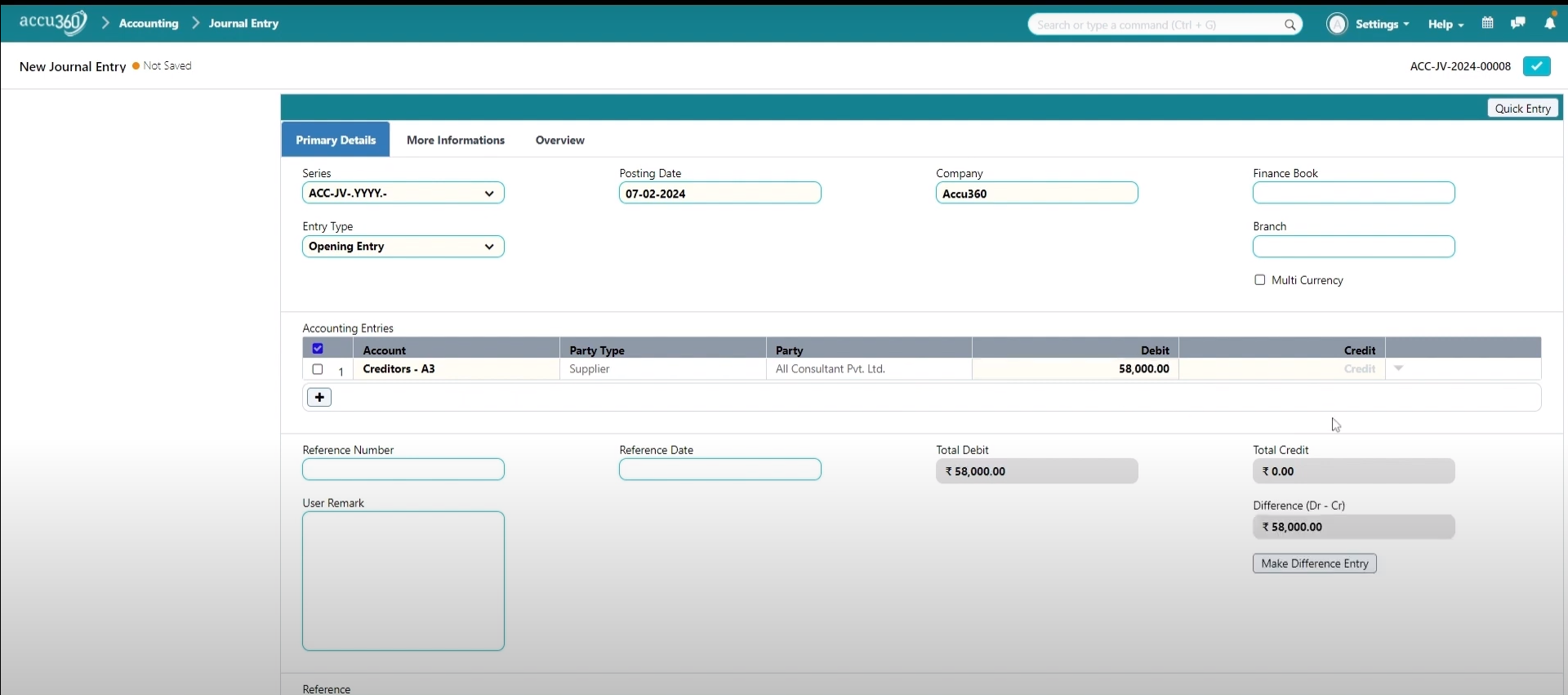

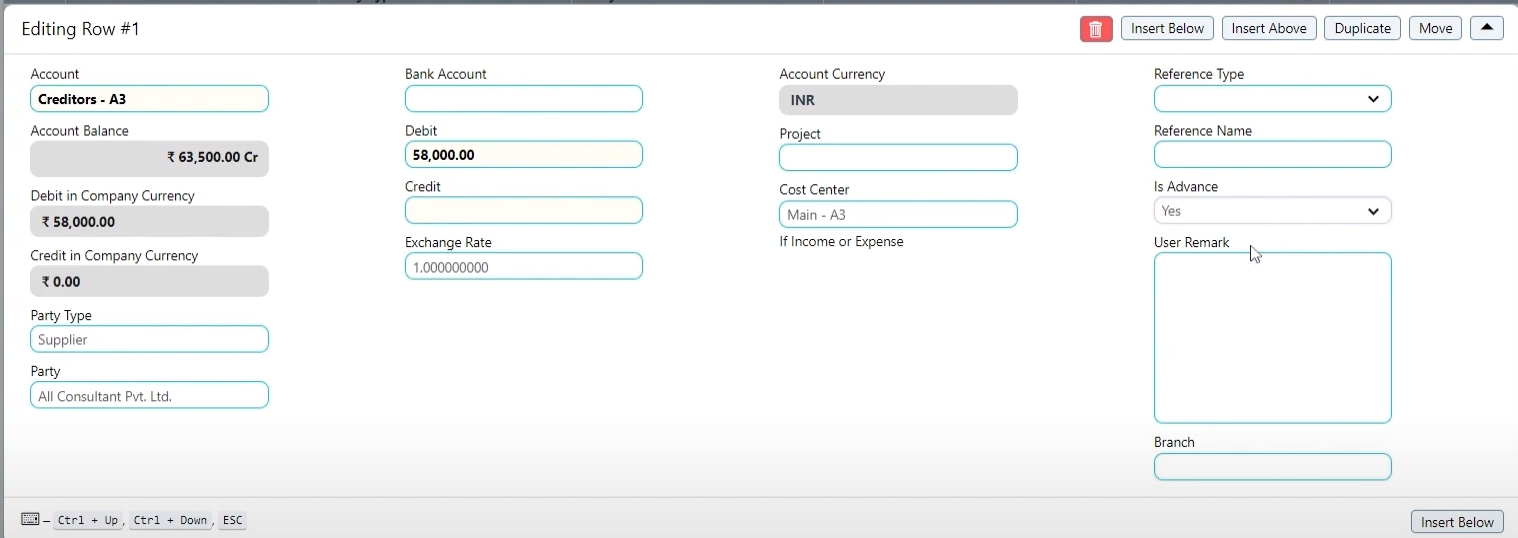

¶ Special Entry - Advances to Supplier

- Handle Special Entries: If there are any special entries follow the above steps to create the opening entry.

- Before saving it Click on the Small Triangle in the last table of Creditors

- The Entry will open in Expand View

- Select YES in “IS ADVANCE” Table

- Finally select temporary account to match the dual effect of the Entry

- Click on the Right Tick to Save & Lock to Permanently Submit