¶ Journal Entry

Journal is core part of accounting and ledger entries. In every transactional document entry there will be journal entry in the back-end automatically as per your account determination. But in some cases we need to pass manual journal entries for so many cases. Like booking expenses,advances , any adjustment etc.

Access journal entry from Home > Accounting > General Ledger > Journal Entry

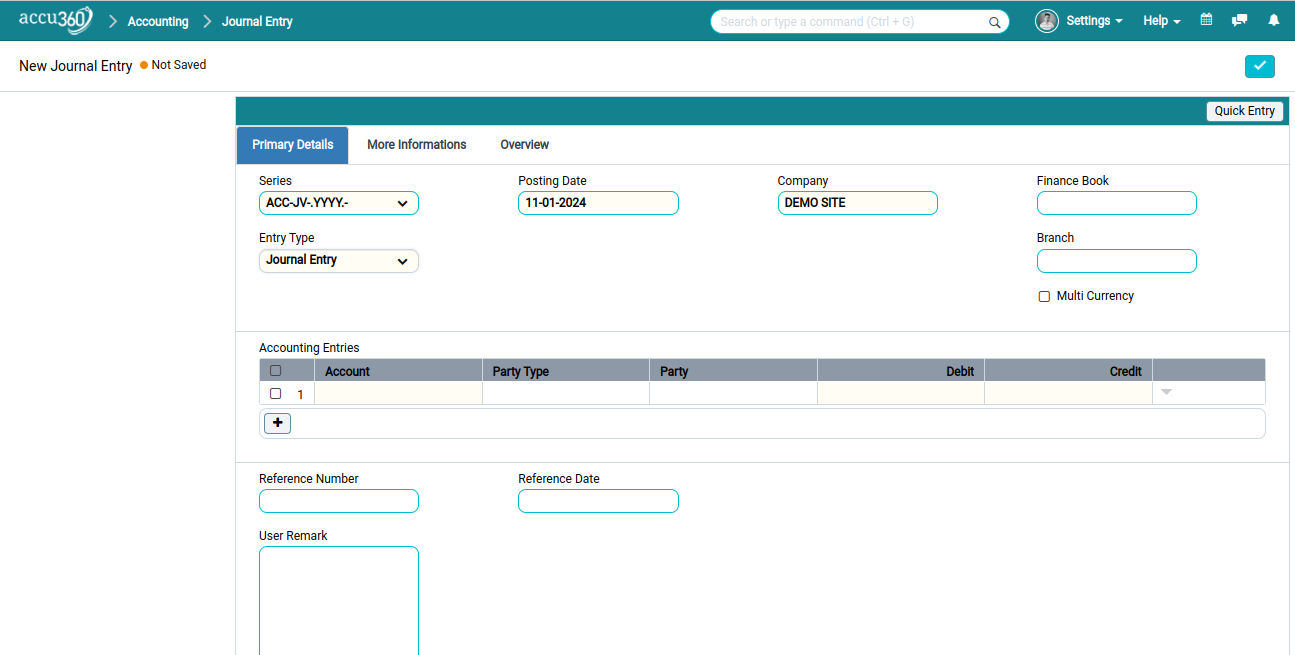

Click Journal Entry then click New from right top corner.

Journal Entry document will look something like below image.

Fill the data as per your requirement.

-

Journal Type: Select the type as per your requirement. Type are required to filter the report. Journal Type has nothing to do with posting. Type is necessary when you are passing any journal entry for particular purpose like for Opening Balance, Debit/Credit note. You can select the type if required or else leave it as Journal Entry.

-

Series: Select series as per your requirement. Series will be the folio number entry wise. For more detail on series go through this link naming-series.

-

Posting Date: Give give date as per your actual transaction. By default posting date will be most current date but still you are passing entry for past then give your date in Posting Date.

-

Company: Company will be your actual company always.

-

If you have multiple Finance Book then select finance book or else leave it blank.

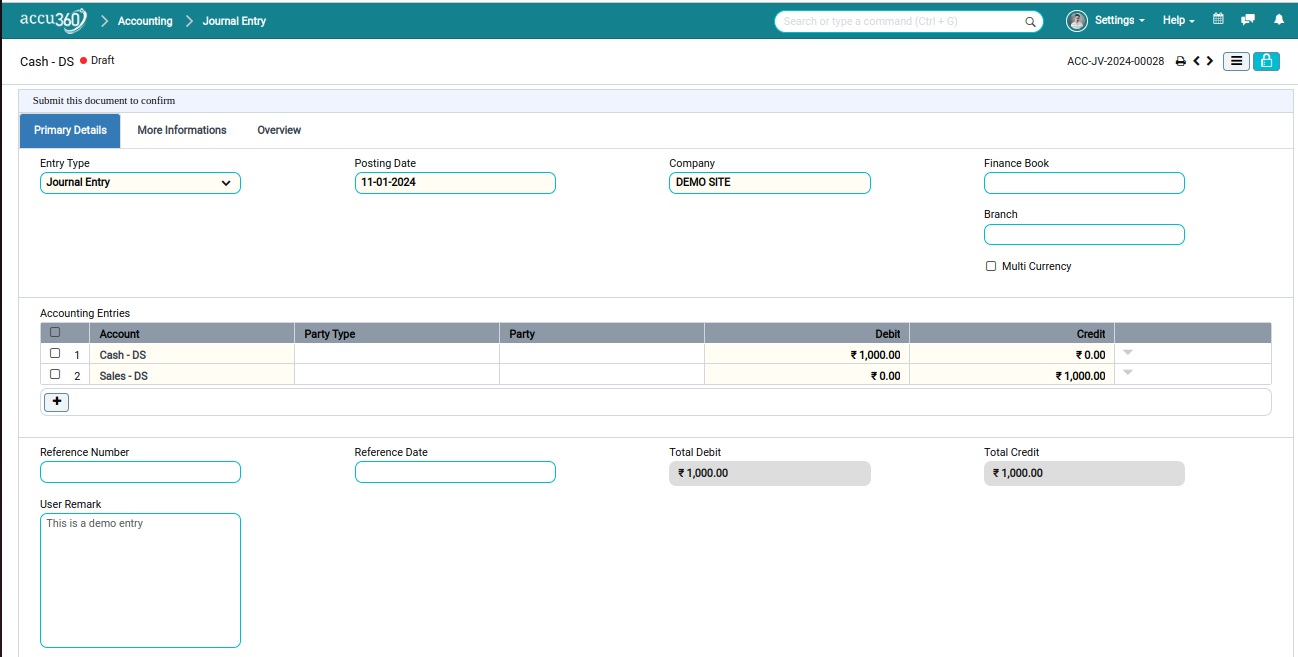

Screenshot for journal entry

In Journal Entry Child Table select your ledger and give debit and credit amount.

Note you should know how to pass a Journal Entry.

- Reference Number: If you have any reference number like bank transaction number or cash then put is here and also reference date.

- User Remark: If you want to give any remarks or clarification about your journal entry then write is here or else leave it black.

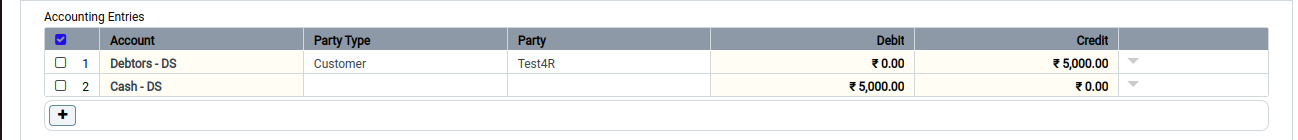

¶ Journal Entry Party Wise

If you want to pass any payment entry via journal entry like for Customer and Supplier then select ledger in jounral entry Child Table appropriately.

Lets Understand it with example you have to pass Journal entry for Custmer of Rs. 10000.

Since it is a customer(Debtor) then in child table we have select account(ledger) as Debtors after selecting Debtor if you take your mouse to party then party name will come automatically. Then select the customer and pass the entry. Same for supplier instead of Debtor select Creditor ledger.

Screenshot of Party wise journal entry

But for party payment we recommand use payment entries.

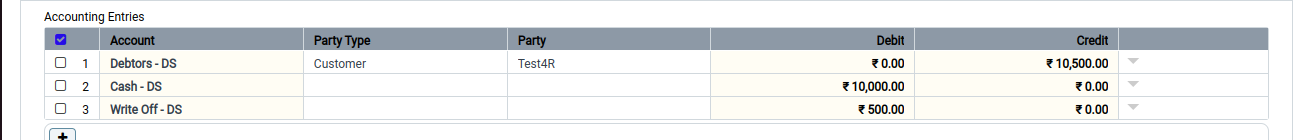

¶ Difference Amount Journal Entry

If your party making you lesser amount than their outstanding amount. Then you have pass difference ledger entry also in same journal entry. We all know that to pass a journal both Debit and Credit should be equal. So how we will pass this entry if party outstanding is bigger than amount we received.

Example: Custmer’s outstanding is Rs. 10500 but party making you a payment of Rs. 10000 and party wants you to close his/her book with 0 (ZERO) outstanding. To pass this kind of journal entry follow the below screenshot image